Table of Contents

01 The Impact of the Suez Canal block on Insurers

02 The Insurance Monthly Roundup

03 The Rise of Cyber Liability Insurance

04 Is India ready for Digital Insurance Ecosystems

05 Telemedicine: The fastest growing use case for Chatbots

The Impact of the Suez Canal block on Insurers

For six days, the Suez Canal was blocked after the accidental grounding of the Ever Given—a Golden class container ship with a capacity of over 20,000 TEU (twenty foot equivalent unit)—one of the largest container ships in the World. The blockage has already created global level fallout by temporarily raising crude oil prices in several parts of the world. On either end of the canal, there were more than 300 ships stuck without being able to pass through.

To play the ‘Who’s going to pay for these losses?’ game, one has to take into account the different parties involved with the ship itself. The Ever Given is chartered by Evergreen Marine Corporation – a Taiwanese container transportation and shipping company, while the ship’s owner, Japan’s Shoei Kisen Kaisha (a ship leasing conglomerate), says charterers have to deal with the cargo owners by themselves. Meanwhile the cargo owners, and owners of the goods inside them will file claims with their respective insurers.

The Ever Given itself is insured around $100-$200 million according to insurance broker Marsh. The loss of trade due to the closure was pegged at around $9 billion per day. Insurers will feel a slight reprieve in that this is a once-in-a-lifetime type of event. However, the volume of claims will be insurmountable, from demand for GA (General Average) and salvage guarantee from cargo interests, to claims under the hull and machinery policy or damages against the vessel, and business interruption losses to losses due to perishable cargo or the cancellation of orders.

In an already hardening reinsurance market, global reinsurers are already facing heavy declines due to paid claims related to the coronavirus pandemic. These latest sequence of events could put additional strain, by pushing prices even higher, on global commercial and reinsurance markets.

The State of AI in Insurance

Read the full report.

The Insurance Monthly Roundup

A quick roundup of the month’s insurance and insurtech news.

(India)

-

Life insurance companies registered a 21% y-o-y rise in new business premium to Rs 22,425.21 crore as compared to the same month last year.

-

Outside of the LIC, the remaining 23 life players saw their collective premiums jump 16.93% since last year.

- As per the Insurance Price Index compiled by PolicyX, the prices of health insurance policies have remained constant despite the rise in COVID-19 cases across the country. The index value remains constant at INR24,026 ($328) in 1Q2021.

- The non-life insurance market is expected to reach INR 3,662.94 Bn by 2024, expanding at a CAGR of ~14.79% during the 2020-2024 period.

- Online insurance aggregator Policybazaar raised $75M to expand its presence across the Middle East and UAE in particular. This brings the total capital raised by SoftBank-backed startup to $630M to date.

- Rajasthan launched a health insurance scheme for all its residents, under which each family in the state can claim up to ₹5 lakh every year for medical expenses.

- The digital insurance marketplace is still nascent and underpenetrated, with online aggregators like Policybazaar forming less than 1% of the digital insurance distribution landscape.

(Global)

- Usage-based insurtech, Zego hit unicorn status owing to its focus on the booming gig economy. Zego offers usage based auto insurance for gig economy workers on platforms like Uber. Their secret lies in applying telematics to the gig economy.

- The Global Travel market is expected to bounce back stronger in 2021, and is poised to grow by $12.6 billion during 2021-2025 at CAGR of 9%.

- Insurance industry recorded 20 IPOs in 2020, and the 2020 fourth-quarter total of $1.59 billion was the biggest for the final quarter of a year since 2015.

- Insurtech Next Insurance partnered with Amazon Business (Amazon’s B2B marketplace) to provide its members access to customised small business insurance. Amazon has already entered the car & bike insurance market with its backing of Indian Insurtech Acko.

- The UK, Germany and France have entered a maturity phase for the past two years (discounting the impact of COVID-19), with very few new entrants in the insurtech ecosystem. The three countries together have over three-quarters of Europe’s Insurtech startups.

Delivering Superior Customer Experiences over Video.

Download Report, here.

The Rise of Cyber Liability Insurance

2020 saw some of the worst cyberattacks across the globe that has impacted millions of lives. The aftermath of the SolarWinds hack—where hackers exploited a vulnerability in the IT management software’s security, led to 18,000 SolarWinds customers downloading Trojan malware—and could result in $115 million being paid out in claims by cyber insurers. SMEs face a greater degree of cyber risk given the typically lower investments and support to implementing effective risk mitigation for data breaches.

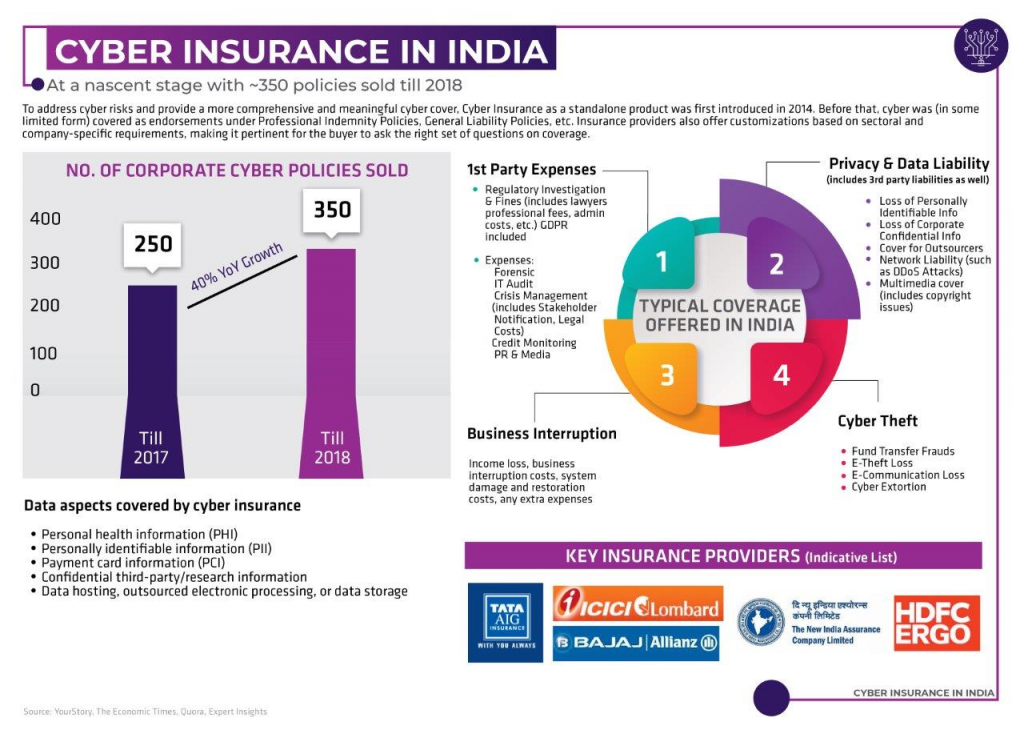

To combat the growing pace of cyber threats, cyber insurance applications are now focusing on risk mitigation events like data back-ups, dual-factor authentication, and strong security practices by third-party vendors. In India especially, a laissez-faire attitude towards cyber risk can create economic turmoil for millions of lives. While cyber insurance is in its infancy, cyber security threats are not.

In fact, they are no longer targeted against the big giant corporations, but instead the smaller enterprises that have low levels of protection against cyber attacks making them easier targets. These attacks are designed to steal personal details of employees, intellectual property, and other sensitive information such as financial data, or even cripple the organization’s network and connected assets through the release of ransomware.

Cyber liability insurance protects organisations from the business disruptions and aftermath of a cyberattack or a hacking threat. In fact, the IRDAI had recently decided against the standardisation of a cyber liability product in India because it would impede innovation and the development of new products suitable for Indian businesses, rather than focus on a strict price-based competition.

Source: Data Security Council of India

By 2025, cyber crime losses will grow to $10.5 trillion, a 15% increase from 2020, according to a recent report. In 2020, the global cyber insurance marketplace touched $7.8 billion in overall premiums written, where 577 carriers wrote some form of cyber insurance. Meanwhile in India, there have been only 350 policies sold till 2018. India was also ranked among the top five countries to be affected by cyber crime. India witnessed a 500% surge in the number of security breaches and four times the number of phishing attacks since lockdowns began last year. If the recent spawn of cyber attacks have been any indicator to India Inc., the demand to neutralize these threats will also start to blossom.

Can Augmented Reality be a game-changer for Insurance?

Read our Latest Blog here.

Is India ready for Digital Insurance Ecosystems?

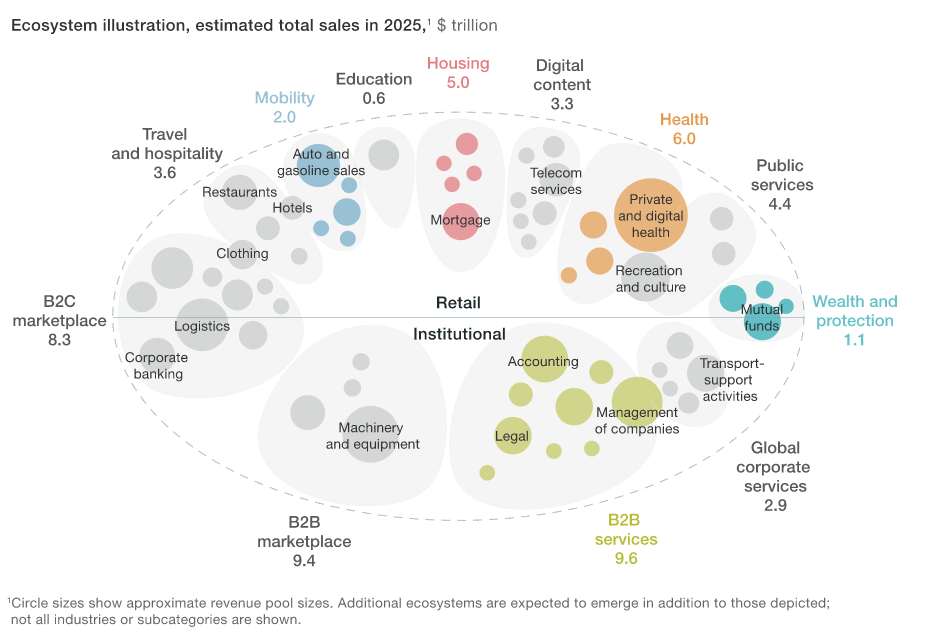

Insurance is already being largely influenced by platforms and ecosystems. Seven of the 10 largest companies in the world by market cap operate within ecosystems, including Apple, Amazon, Alibaba, Microsoft and Facebook. According to Mckinsey, by 2025, 12 distinctive ecosystems will emerge, accounting for $60 trillion in revenues, or close to 30% of all global revenues. The benefits of participating in an ecosystem are that no single enterprise needs to own or operate all the component parts of an insurance solution.

Mckinsey identifies three key values for ecosystem players:

- Ecosystem players can be gateways that reduce friction for customers wishing to switch between related services.

- Ecosystem partners can integrate data across several different services, providing better and more personalised solutions to customers.

- Enterprises can also mutually harness the benefits of network effects.

A recent Accenture survey of Insurance industry professionals highlights the growing importance for C-level execs to add ecosystems to their overall digital strategy. 54% of insurers are actively seeking to join an ecosystem model because of the potential to open new revenue streams.

Traditional Industries Replaced By New Ecosystems

Source: IHS, McKinsey

Source: IHS, McKinsey

The rise of the gig economy has shifted consumer & business behaviors from asset purchase to asset usage. According to an Accenture survey, 4 out of 5 insurers stated that ecosystems were important to their overall strategy, of which more than half were actively seeking out ecosystem partnerships. In Fact the level of interest in ecosystems was the highest within insurance.

Reimagining Medical Diagnosis with Chatbots.

Read our latest blog, here.

Telemedicine: The Fastest Growing Use Case for Chatbots

In 2016, the telemedicine market in India was valued at US$ 15 million and was expected to rise at a CAGR of 20 per cent during FY16-20, reaching US$ 32 million by 2020. The digitally enabled healthcare consumer is informed, proactive and above all lives in an omni-connected world. In India, the telemedicine and remote care market alone is valued at $5.4 Bn for 2020

The rising Covid-19 cases have increased dependencies on technology for health consultations. People are resorting to telemedicine platforms such as Practo, Ask Apollo and iCliniq for online consultation with doctors. As per IRDAI guidelines, here are the implications for Insurers.

- OPD Cover: telemedicine expenses will be treated equivalent to OPD coverage.

- Video KYC: KYC for customers allowed over video conferencing software with specific compliances.

- Claims: the norms of sub-limits, monthly or annual limits, which are specific to a policy will apply to telemedicine claims as well.

- Out-of-pocket expenses: the cost of pharmacy and consumables, implants & medical devices, and diagnostics as a part of associated medical expenses, which come under proportionate deductions will not be considered.

Healthcare tele-consultations has risen by 500%, of which over 80% were first-time users mostly from smaller cities, while the average time spent with a doctor online was eight minutes. In fact, more consumers today are getting their prescriptions and medical advice through virtual visits than ever before. According to a recent FICCI-BCG Report, 60% of patients across metros and tier 1 cities will continue using digital platforms for primary care in the post COVID world

Telemedicine has undertaken a new way for doctor consultations. Apart from remote consultations, Telemedicine will also provide good-quality healthcare data in a ready-to-use format. In the future, this will help Insurers in identifying the state of policyholders’ medical condition and steer the move from financial protection plans to health-centered designs.

Digital Everything UseCases for the Post-COVID World.

Read our latest Use Cases here.

Business cognizance for the new-age digital insurers