Table of Contents

01 Elevating Conversational CX In Insurance

02 The Insurance Monthly Roundup

03 Mega Trends in The Post-Pandemic World

04 Max Life’s India Protection Quotient survey 2022: Key Takeaways

05 9 Key Strategic Moves for Insurers to keep in mind

Elevating Conversational CX In Insurance

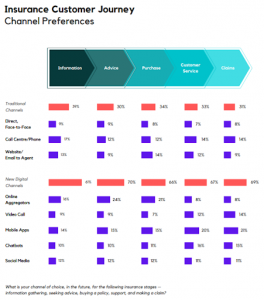

Most insurers today accept the central role of CX in selling products and maintaining the loyalty of both policyholders and agents. However, Insurers typically struggle to elevate their CX due to its low-touch engagement nature, channel complexity, and price sensitivity. Adopting CX technologies allows Insurance enterprises to enable scale & speed, engineer new experiences, and analyze behavioral data. Within this rubric is the convergence of CX-specific tools that help understand how customer groups think & behave, and the experience of individuals

Our latest research uncovers key insights for the Future of Conversational CX in Insurance, with a detailed guide towards being a Conversational CX-driven Insurance Enterprise. This report also highlights how CX tools & solutions form a critical starting point for transforming simple touch points into connected experiences.

Source: Mantra Labs Report

40% of Carriers view private messaging channels as the biggest disrupter in the next 12 months. During the past year, 69% of consumers have used a private messaging channel – such as Facebook Messenger, Twitter DM, WhatsApp, iMessage, SMS, etc. – to engage with an insurance brand. 84% of Gen Z, and 76% of Millennial customers say they would prefer to use conversational chatbots that offer ‘simple and convenient experiences’ as their primary mode of interacting with an insurance brand.

Elevating Conversational CX In Insurance

Read the full report.

The Insurance Monthly Roundup

A quick roundup of the month’s insurance and insurtech news.

(India)

- LIC filed a draft with the market regulator to sell 5% of its share in order to raise about $8 billion, dwarfing the biggest IPO in Asia (Paytm) by a considerable margin.

- Nova Benefits received an undisclosed funding amount from Naval AngelList Early-Stage Quant Fund. The company will utilize this infusion to set up an Analytics Division which will be used to track hiring and employee wellness trends.

- Claimbuddy raised $3 million in a Pre-series funding round which will be used to strengthen the technology framework and boosts sales and marketing efforts. The company aims to provide a cashless-claim experience at hospitals by leveraging their technology.

- RenewBuy acquired Artivatic.AI for $ 10 million which will be infused to extend its tech solutions across the entire value chain and improve consumer solutions related to insurance claim settlements, risk assessments, and underwriting.

- Insuremile raised $3,50,000 in a pre-seed funding round which will be used to provide insurance to the rural population while also covering the country’s more than 200 million gig workers.

- Tamil Nadu government launched a welfare and insurance scheme for one lakh construction labourers during the 14th edition of FAIRPRO-2022. The scheme would cover and support the labourer and family in case of expenses ranging from accidents to maternity regardless of the builder they work for.

(Global)

- FloodFlash raised $15m in Series A funding round which will be used to expand into international markets including US, Germany, Australia, and Japan.

- CCC Intelligent Solutions (CCC), a SaaS platform for the P&C insurance economy has acquired Safe keep which will help CCC to include subrogation management and deliver end-to-end straight-through claims processing.

Conversational Intelligence: The Next Big Thing In Customer Experience

Read our Latest Blog here.

Mega Trends in The Post-Pandemic World

Covid crisis has brought on dynamic changes in the customer and employer behaviour. While most of these practices aren’t entirely new, they’ve picked up speed throughout the pandemic and are creating a new operating environment for insurers that is highly disruptive and undermines conventional value creation practices. These trends are as follows:

- Change in macroeconomic situations due to geopolitical and trade conflicts, varying interest rates in different regions. For example, a spike in inflation may put pressure on life insurers to revamp their business model from low to high interest rate accordingly.

- Wide Gap between the ‘winners’ and ‘loosers’. Covid crisis has distributed economic profit unequally along a power curve with top 10 percent of the companies capturing 80 percent of it especially at the company level. As a result, half of the insurers are not earning their cost of capital, while the other half are trading at a discount to book value.

- A customer based remote-interaction models. To remain relevant and create fully personalized, context-based experiences for customers, insurers will face stiff competition from insurtechs and digital attackers. There will be a dire need to make additional IT investments to fully automate and digitalize the process and modify their distribution models by repositioning the roles of agencies, brokers, and digital sales channels.

- More awareness of sustainability, climate change, and issues of diversity, equity, and inclusion (DE&I). Growing awareness of environmental and energy crisis and injustice amongst customers and corporates will have an immediate impact on insurers, particularly in their investment and underwriting portfolios. Insurers will have to assess whether their pricing models account for these situations.

- New challenges to the purpose and relevance of insurers. There is a notion that the insurance sector has lost its quality in the last ten years by limiting the types of risks or consumers it covers, especially in Europe where life insurance has moved sharply toward unit-linked products. Pandemic might push insurers to reconsider their societal purpose and relevance as a risk-taking industry.

- Rethinking of mobility: There has been a drastic change in the transportation and modes of travel. Work from home and culture and increasing preference for private over public transport could prompt insurers to rethink and develop their policy offers in highly impacted lines of business (such as life, travel, and events).

- New Ways of working: With hybrid working model, insurers must assess the skills needed to manage remote and hybrid teams, as well as their housing needs to accomodate changing workforce and fit clients’ evolving geographic footprints (for example, as people move to midsize cities, suburbs, and exurbs).

- A renewed interest in health and well-being and home parenting. Pandemic has encouraged insurers to actively participate in health and protection ecosystems. At the same time, home nesting is one of the new behaviors most likely to endure after the pandemic, according to the McKinsey Global Institute. Insurers might invest in smart-home8 services and offerings such as discounts on homes equipped with devices that can detect fire, flood, or unwanted visitors.

Delivering Superior Customer Experiences over Video.

Download Report, here.

Max Life’s India Protection Quotient survey 2022: Key Takeaways

The fourth edition of Max Life Insurance’s India Protection Quotient survey (IPQ) has been released, highlighting the gradual growth in Urban India’s Protection Quotient, which has now reached 50, with increased vaccination coverage and a growing positive outlook beyond Covid-19.

According to the report, urban India’s knowledge index jumped by one point to 69, while the security index increased by 5 points to 56 percent. The protection index increased in metros, Tier 1 and Tier 2 cities, while life insurance awareness in Tier 2 increased significantly from 61 to 68, suggesting considerable potential for life insurance penetration in Tier 2 markets.

Trends in Urban Indians’ Financial Preparedness:

- More Diversified Investment: Even though there was no change in life insurance ownership from IPQ 3.0 Express, participants created a holistic profile by investing more in life insurance products term (43%) and market-linked (19%) life insurance products, as well as savings plans (39%).

- Protection Index Highest In South Zone: The protection quotient for the South zone increased from 49 to 51 in IPQ 4.0, followed by the North (50), East (49) and West (49) zones. In this survey, metros witnessed a considerable increase in security levels from 48% (IPQ 3.0 Express) to 56%, while Tier 2 cities gained 7 points in life insurance product awareness and hit 68. With growing awareness about life insurance, the metros and Tier 1 and Tier 2 cities are gradually gaining ground.

- Personal Well-being is a top priority. According to the survey, the majority of covid-related fears, such as the breadwinner’s early demise and probable Covid-19 exposure, have decreased to 59% and 51%, respectively. However, with the pandemic straining mental and physical health, personal well-being (62%) has emerged as a major priority for urban India.

- Increasing Savings & Investment plans: The urban population is majorly focusing on children’s education and retirement plans. With occasional lockdowns and restrictions, savings and investments climbed from 53% in IPQ 3.0 Express to 56% in IPQ 4.0, while basic and luxury expenses decreased to 29% and 15%, respectively.

- The ‘Most Valuable Currency’ is Safety. IPQ 4.0 found that 88 percent of respondents chose to invest in fixed deposits and guaranteed income life insurance plans to protect their future against market uncertainty. Only 11% of investors prefer to invest in market-linked products such as mutual funds, equities, and ULIPs.

As the Indian population is more conscious of securing their financial future now, insurance penetration will sure to have a positive outlook in the coming future.

India’s evolving Insurance landscape during the Pandemic

Read our Latest Blog here.

9 Key Strategic Moves for Insurers to keep in mind

With the global pandemic changing the insurance landscape over the past two years, Insurers are faced with a multitude of core strategic problems, including how to increase shareholder value. Will they be able to tap into hidden demand and improve the consumer experience? Carriers will be able to answer strategic questions about “how to play” if they address these nine imperatives:

- Make environmental, social, and governance (ESG) considerations a core feature of the business model.

- Regain relevance through product innovation and coverage of new risks.

- Enhance and personalize customer engagement and experience.

- Engage with ecosystems and insurtechs.

- Develop new businesses for the digital age

- Scale impact from data and analytics.

- Modernize core technology platforms.

- Reimagine culture, diversity, and ways of working to attract and retain talent.

- Address the productivity imperative.

CX Trends 2021: How Businesses are Winning Customer Experience Moments

Read our latest blog, here.

Business cognizance for the new-age digital insurers