Case Study

RELIGARE: A HEALTH INSURANCE EXPERIENCE THAT CUSTOMERS SWEAR BY.

One of India’s top health insurers, with a footprint spanning across 1,700+ locations, Religare – sought to purge their processes off bottlenecks affecting both their customer’s journey and the sales funnel. The Health Insurance specialist worked with Mantra Labs to affix a set of intelligent solutions across their insurance & products life-cycle.

A complete reimagining of their digital assets put Mantra Lab’s user-centred design approach at the core of delivering a seamless customer journey. Through the Religare ‘Health App’ (rated 4.5 on the google play store), customers are now able to navigate through health related information about policies, claims and support in faster issuance workflows.

Through an AI-empowered insurance chatbot, Mantra Labs delivers a 5X increase in conversions via chatbots when compared to web or mobile, demonstrating a 10X increase in customer interactions.

Mantra Labs provides a bespoke solution fitting the insurer’s need and brought significant value back to the organization.

Read our complete case study on the journey we took with Religare.

To know more about how Mantra Labs capabilities solves complex insurance needs, visit our site.

Opinion

THE HIDDEN COSTS OF DATA BREACHES

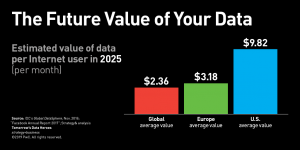

Any application or service, take Google Mail for example, that has millions of users logging in every single day – creates data. The sheer volume that is generated and then sorted through, in order to verify if the account was accessed by the right person or an impostor, is extremely daunting. Even worse, the volume keeps growing, to a degree that humans alone are not capable of writing rules for every single instance. This is where AI becomes an important ally.

In the last decade or so, there have been over 200 million customer records exposed in the financial & insurance services space. Surprisingly, 150+ million of those, were either exposed or stolen in the last two years alone!

With AI, the ability of a system to observe and detect any potential threat to an organization’s business apparatus significantly improves. Together with blockchain integration – systems can be trained on anomaly detection, firewall intrusion detection and data loss prevention.

All manner of industry and business remain incredibly vulnerable to the malicious targeting of anonymous hackerism. Famously Yahoo, Cathay Pacific, Anthem, PlayStation Network, even the Prime Minister of Singapore were not spared from within the encrypted veils of internet privacy.

The history of corporate hacking tells us that there are three types of businesses; those that have been hacked, those about to be hacked, and those that don’t know they’ve been hacked. The cost factors surrounding a breach such as investigations, recovery costs, notifications to the affected, as well as cost of lost business and reputation, can be crippling to an organization’s fortunes.

For data breaches of size around 50 million records exposed, companies lose on average USD 118M, according to an IBM study. Breaches cost companies US$148 per lost or stolen record on average.

While, data breaches are also the costliest in the US and the Middle East, they are the least costly in Brazil and India.

Bloomberg News has compiled a nearly thorough list of the ‘Worst Corporate Hacks in History’ across all industries. View this infographic.

Read our latest blog on ‘A Reactive Approach to Security by Insurance Firms’.

Opinion

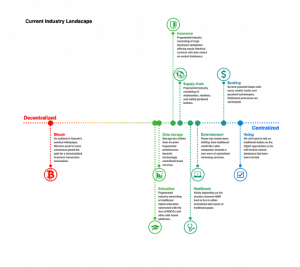

DECENTRALISED BLOCKCHAIN Vs THE $40b YEARLY FRAUD IN INSURANCE.

Statistically, claims within the ‘first year of policy’ are most likely to be a fraudulent claim. In the Indian context alone, annual fraudulent claim losses stood at $6.25 billion, according to a release by the India Forensic Center of Studies.

Via predictive modelling, companies are able to accurately ascertain the level of risk arising from a particular region, based on historical data and trends. The real advantage of blockchain implementation, is that every actor in the value chain is presented with independently verifiable data, which reduces the possibility of data corruption.

However, the growth of this technology is critically dependent on both ‘insurer’ and ‘users’ agreeing on common shareable data standards, which is were Blockchain finds itself in early 2019. With the market outlook promising a 65.9% CAGR over 2019-2027, there is plenty of utility and cost-savings, up for grabs. The move towards a decentralized structure can provide, in the long run, beneficial outcomes to both insurers and users.

Read our latest blog for more on ‘Strategic Technology Trends in Insurance’.

Insights

AI CHATBOTS WILL LEVEL-UP ACROSS INSURANCE⥌

- Chatbots are expected to generate over US$8 billion in savings globally by 2022.

- According to industry experts, chatbots are still poised to be the leading consumer AI application for the next five years. (text)

- The European market leads in terms of the number of chatbots across insurance (45%), followed by North America (28%) and APAC (21%).

- Most chatbots in Europe are at a basic level in terms of maturity, while North America has a healthy mix of moderate and advanced bots.

- Asia Pacific is in line with Europe in terms of its maturity mix of

basic (62%), moderate (25%) and advanced (13%) bots. - Overall, most chatbots remain at a basic stage.

- Enhancing bot capabilities will derive the maximum value for insurers.

Bot capability is derived from the maturity of the bot; either basic, moderate or advanced. Based on this spectrum, ‘basic’ implies that a bot is mostly rules-based and can only follow simple instructions often deferring to a human, whereas those bots that are closest to a true human-like conversation, are classified as ‘advanced’ in terms of their capability.

Most chatbots in Europe are at a basic level in terms of maturity, while North America has a healthy mix of moderate and advanced bots. Asia Pacific is in line with Europe in terms of its maturity mix of basic (62%), moderate (25%) and advanced (13%) bots.

Of insurers that have utilized chatbots in their operations, a majority 68% utilise only a basic form of the technology, which poses significant opportunities for the uptake of bots that can add more value across the insurance value chain.

⥌According to Mantra Labs internal findings report, 2019.

Read more on this whitepaper by Cognizant Research, here.

| News

HAVEN, A NEW TYPE OF HEALTHCARE ORGANISATION The venture of three giants: Amazon, Berkshire Hathaway & JP Morgan Healthcare, now has a name. Haven, is ambitiously looking to change the healthcare experience – simple, better & low cost. Free from profit-making constraints, they are looking to serve their combined 1.2 million employees and their families, across the US. Read more here. |

News

THE ‘PAY-AS-YOU-USE’ INSURTECH HAS ARRIVED Synagie’s Kiasu.me is an Insurtech offering start/stop – pay only when you use – insurance. They cover lifestyle related risks such as mobile screen damage, cyber risks, online shopping disputes etc, for low-cost premiums, They are underwritten by several A-rated insurers, and are poised to disrupt the insurance space in Singapore.

|

Business cognizance for the new-age digital insurers