Table of Contents

01 What’s Next: Insurance via Digilockers

02 The Insurance Monthly Roundup

03 Reimagined: Insurers role in Patient’s Healthcare Journey

04 AI is Changing the Face of Agent Customer Interactions

05 Why Are P&C Insurers turning to the Cloud Post COVID?

What’s Next: Insurance via Digilockers

Insurers have been advised by the IRADI to begin the process of educating retail policyholders on using the government facility for storing their insurance policies. The initiative is a welcome move towards a paperless policy experience, where the end user can store authentic documents in digital formats from the original issuers of these certificates.

The Digilocker facility is expected to bring multi-fold business and administrative benefits to the Insurance sector. Some of these benefits include:

- Driving down reduction in costs

- Elimination of customer complaints relating to non-delivery of policy copy

- Faster Turnaround Time (TAT) of insurance services

- Faster claims processing and settlement rates

- Reduction in document fraud/loss and other disputes

- Improvement in customer contactability

The Government’s online storage facility already claims to have nearly 43 crore policy documents stored on its app. This has been facilitated through the platform’s adoption by eight leading insurance companies who have integrated with the platform, namely: New India Insurance, ICICI Lombard, Reliance General Insurance and Go Digit General Insurance.

Adoption among citizens has increased over the past 5 years owing to its use as a document storage facility for all kinds of important government issued certificates. Among the documents stored on the platform, Aadhaar tops the list followed by PAN, Insurance policy (for two-wheeler), LPG subscription and vehicle tax receipts.

As of 2021, DigiLocker has over 35 million registered users, with over 77% increase in registered users in the last 12 months. Notably, Maharashtra, Gujarat, Uttar Pradesh, Karnataka and Tamil Nadu are the top five states whose residents have adopted DigiLocker to store their documents.

The State of AI in Insurance, 2021

Read the full report.

The Insurance Monthly Roundup

A quick roundup of the month’s insurance and insurtech news.

(India)

- According to IRDAI’s annual report, the Life industry experienced a decline in net profits to Rs 7,728.30 cr, down by 8.4 % for FY20. Of the 24 life insurance carriers, 17 reported profits in the 2019-20 period.

- Life insurance penetration in India has been increasing at a modest pace since reaching its 3.5% in 2015, touching 3.76% in 2019; while insurance density (per capita premium) has also climbed to USD 78 (₹5,679).

- Life insurers settled as many as 8,74,849 claims, with a claim settlement ratio of 96.76 per cent.

- The non-life sector saw its underwriting losses increase by 6.2% in FY20 largely on the back of losses suffered by public sector insurers in segments such as fire, motor and marine segments.

- Health insurance penetration by 2025 insurance is expected to grow to 5% penetration with 10% CAGR and is set to expand significantly over the coming 12-24 months due to rising health concerns.

(Global)

- Global insurance and insurtech companies raised about $3.83 billion from IPOs in 2020.

- The Global Insurance industry recorded 20 IPOs in 2020, and the 2020 fourth-quarter total of $1.59 billion was the biggest for the final quarter of a year since 2015.

- Insurtechs formed four of the top 5 IPOs in 2020 — GOHealth, Root, DuckCreek and Lemonade.

- A record number of climate change induced disasters like hurricanes, wildfires and floods cost the world $210 billion in damages for 2020. Overall disaster losses in Asia totaled $67 billion, of which only $3 billion was insured.

- The global InsurTech market was at $7 billion in 2020, and it is expected to target a robust growth rate through 2025 on the backs of new business models encouraging digital self-service and personalised premiums.

Delivering Superior Customer Experiences over Video.

Download Report, here.

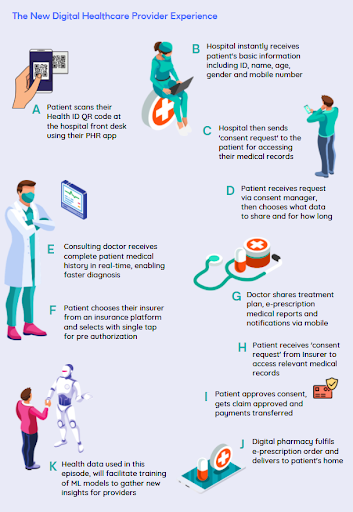

Reimagined: Insurer’s role in Patient’s Healthcare Journey

Currently, 63% of healthcare in India is financed through out-of-pocket (OOP expenditure. The health insurance penetration is low and limited largely to in-Patient Department (IPD) coverage. Given the high claim processing costs (including cost of detecting fraud) outpatient coverage is not an economically viable product for health insurers in India.

According to BCG research, the share of private insurers in healthcare spending is expected to increase from the current 5 percent to about 8-10 percent over the next 10 years, decreasing the share of OOP expenditure.

The creation of a single patient identity and integration into the National Digital Health Ecosystem will allow insurance (payers) to get exposed to new OPD & IPD demand pools. This will help offset fixed costs and change pricing for the treatment funnel, that was previously price indexed for a localised populace only.

With the proposed ‘national claims engine’ and a robust registry infrastructure, the claim processing cost and time will potentially reduce manifolds. India’s OPD rates are currently only at 4 per day per 1000 population. This opens opportunities for insurance companies to provide new products such as OPD cover. Additionally, with insurers now having better view on claim analytics and consent-based access to personal health records of patients, they will be able to price premiums more accurately, incentivizing for better health outcomes.

Can Augmented Reality be a game-changer for Insurance?

Read our Latest Blog here.

AI Is Changing The Face of Agent-Customer Interactions

In an era where contact channels are expanding rapidly, and the amount of data created – both structured and unstructured are mountainous. Organizations are drowning in data, but starving for actionable insights. Keeping up with the ever-changing behavior of consumers is hard for businesses of all sizes.

To meet these expectations, companies are adopting the use of AI along with human intelligence. Statistics revealed that IT spending of Insurance companies for AI has increased from USD76 million in 2016 to USD751 million in 2021

- AI for Hyper-Personalization

Hyper-personalization leverages AI and real-time data to deliver content that is relevant to a customer in no time. It eliminates the traditional way of agents to think, waiting on hold for a phone call, or clicking through tons of pages to find the right info.

Based on the historical data stored, AI serves a personalized experience and eliminates all the pain points in a customer journey. Hyper-personalization focuses on 3Rs—Right products, at the Right time through the Right channels. Therefore, a lot of insurance companies are adapting this to deliver the right products at the right time through the right channels.

- AI for Capturing Customer’s Intentions

Artificial Intelligence helps insurance businesses in detecting the intent of the customers based on their behavior and gives actionable insights to the agents. It maps and analyzes the current customer journey to understand the touchpoints and experiences that customers have with your brand—from discovery, presales, sales, customer service, and beyond.

AI uses billions of data points to systematically develop customer’s personas. Which help agents to:

-

-

- Match customers to the packages they’re more likely to opt

- Display the most relevant content and apt answer

- Save time and make a hassle-free customer experience

-

- Enhanced and Errorless Lead Management

It’s a human tendency to make errors. Therefore, it is often possible for agents to fail to take follow-ups and keep regular contact with potential customers.

AI can aid agent representatives by sending out contextual and relevant messages to a prospect via emails or text messages in a timely cycle. This allows sales teams to focus more on qualified leads that require full human interference, while AI systems can help engage customers, nurture leads, and use smart recommendations for timely follow-ups.

- AI in Fraud Detection

As per studies, the insurance industry collects over $1 trillion per year and the cost of insurance fraud is estimated to be $40 billion every year. Therefore, it becomes extremely important for insurance companies to dodge frauds.

With the help of AI, the insurance companies or agents can analyse historical data of genuine customers and identify a set of patterns. This pattern can be used to detect fraud at an early stage and reduce occurrence of big losses.

- Claims Management with AI

AI empowers agents to streamline the end-to-end process for claim management. With the minimal management of humans, AI can efficiently manage all the processes from data capture, settlement creation, authorization and approval, payment tracking, salvage and recovery tracking, legal matter processing to communication management

The three Vs of today’s chatbots: Voice, Vernacular and Video.

Read our latest blog, here.

Why Are P&C Insurers Turning to the Cloud, Post-COVID?

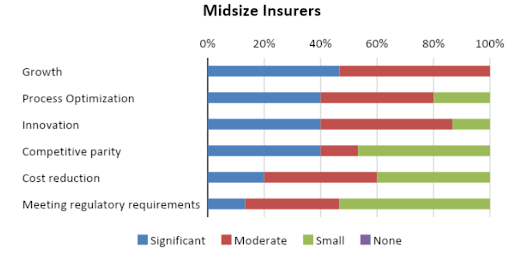

In a recent annual survey conducted by Celent, a leading research and advisory firm focused on technology for financial institutions globally, CIOs at North AMerican P&Cs reported that growth & process optimization were the top corporate goals for their 2021 tech plans.

Insurers in the region, have prioritized these goals in an attempt to push back against COVID-delayed tech investments in 2020. Some of these include spending plans to enhance current systems, such as policy administration and claims systems.

Source: Celent Research North American Property/Casualty CIO Survey

Source: Celent Research North American Property/Casualty CIO Survey

CIOs also expressed that Cloud-ready and cloud-native solutions are the most favored deployment options, especially among large carriers. Cloud allows insurance businesses to integrate risk data, risk assessment reports, and various risk indicators within its framework to help you protect your data against multiple thefts and breaches

Source: Celent Research North American Property/Casualty CIO Survey

Much of the discussion about cloud computing, both in insurance and in other sectors, tends to focus on its ability to reduce IT costs. However, this is only one part of the cloud story. Beyond the infrastructure and technology impact, cloud deployments offer major opportunities for insurers to build a more flexible, nimble and customer-centric business model that can drive profitable growth and help them achieve high performance for the digital insurance era.

Digital Everything UseCases for the Post-COVID World.

Read our latest Use Cases here.

Business cognizance for the new-age digital insurers