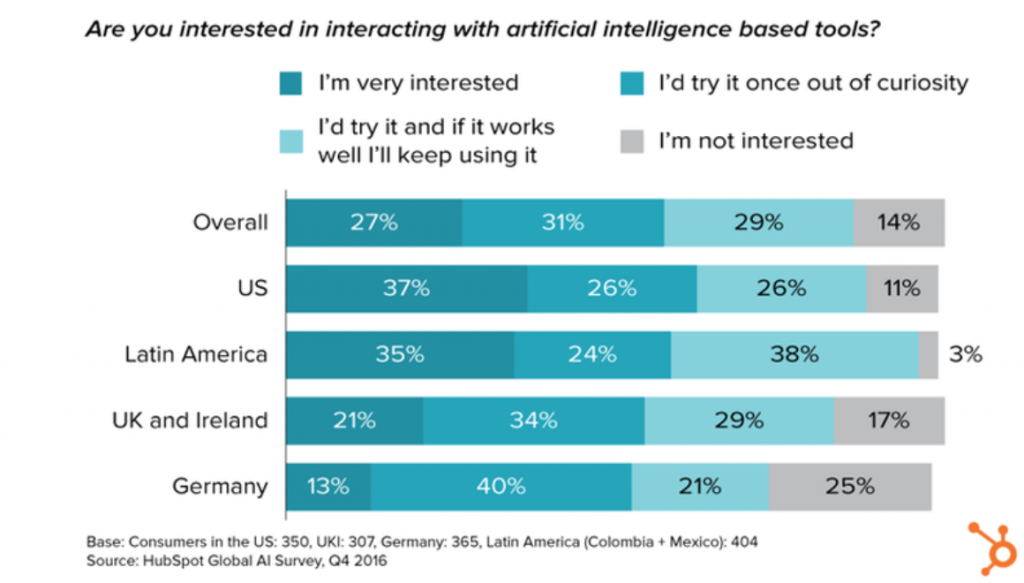

Although buzzwords like Artificial Intelligence, Machine Learning, Deep Learning are loud enough. Many of us still believe AI synonym to Robots. As stated by ZDNet – In one of the surveys conducted by Hubspot of more than 1,400 people from Ireland, Germany, Mexico, Colombia, UK, and the US, they found that many respondents did not know that they were already using AI.

However, of the respondents who said they had not used AI, 63 percent were using it. They just were not aware that they were.

Image Source ZDNet

And if you also thought that you are not using an Artificial Intelligence tool, lets sail through your daily activities to help you in figuring out AI tools that are now a necessity.

Google Maps/ Google Search/ Google Photos/ Google Translate

Yes, all of these default apps on your smartphone uses artificial intelligence and machine learning. As you start typing into the search field, the box responds with some of the search terms as suggestions. The suggestions shown are derived from looking for similar words you types, what is trending or your location.

Google photos, on the other hand, scan and identifies similar images and group them/animates based on date/occasion or people. It again uses artificial intelligence and is driven by robust algorithm to locate/group similar stuff.

With individuals sailing on foreign land, Google translate is another handy tool that was built using Artificial intelligence technology. Algorithms/programs used to read and analyze millions of existing translated documents and built specific vocabulary for a particular language. While a user types in a word in his preferred language, the programs look for the most suitable match and provides a translation in the desired language.

Email Filters

Ever wondered how an email lands into the spam folder when a user hasn’t manually selected it? Or why some emails are under promotions? It is again the magic woven by machine learning. The spam filter analyses the sender’s address tracks the network address maintain a list to be referred later,and as an email hits the recipients server, it scans against its data center and labels it appropriately.

Fraud Prevention

I remember when I was making a transaction through my credit card and twice entered incorrect CVV number. Within minutes I got a call from my bank asking if I am the one making a purchase or is it someone misusing the card. In fact, another incident when I was at my native place and logged into my bank account from a new IP, I was alerted via an email and an SMS – there is a new login from an unknown IP.

All of these fraud prevention techniques are possible because of Artificial intelligence as a monitoring tool.

Social Media

Social Media viz Facebook, Instagram, Twitter, Snapchat, Pinterest that are a lifeline to many uses Artificial Intelligence extensively. Facebook or FB uses AI to present you a personalized newsfeed,and even alters the post that you see on your page.

Instagram recently used AI to replace slang with emojis; just for e.g., if you type rofl it would suggest you emojis or hashtags and make emojis more meaningful.

AI is everywhere and expanding its reach on a daily basis. Although all of this is running in the background, we would love to see self-driving cars and kitchen appliances communicating to Siri, Cortana or Alexa. Possibilities are limitless.

Knowledge thats worth delivered in your inbox