Artificial Intelligence may be a concept unknown to a majority of consumers, but we unknowingly using AI in our everyday life. How? What about the smartphones with Google now and Siri, they help find information for you when you need it.

With real-time problem solving skills the only thing you have to worry about are your goals as you can leave the assistance to a computer that can think on it’s own but for your benefit. Many intelligent brains working in Artificial Intelligence to make our life comfortable. If you could have someone looking over your day to day needs it’s rather easy to focus on more important things in life. Implementing AI into our lives has been studied for years and now things are getting more real and Mantra Labs is well invested into it.

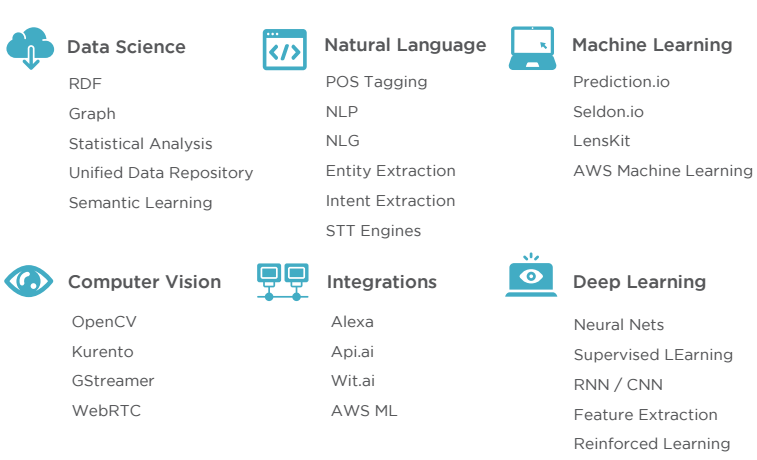

From consulting on niche technologies, to completely owning your AI initiative – Mantra Labs help you solve complex real world problems, leveraging their expertise in various aspects of AI.

• Data Science: It is the study of where information comes from, what it represents and how it can be turned into a valuable resource in the creation of business and IT strategies.

• Natural Language: Natural Language Processing (NLP) refers to AI method of communicating with an intelligent system using a natural language such as English. Processing of Natural Language is required when you want an intelligent system like a robot to perform as per your instructions, when you want to hear a decision from a dialogue based clinical expert system, etc.

• Machine Learning: It is a type of artificial intelligence (AI) that provides computers with the ability to learn without being explicitly programmed. Machine learning focuses on the development of computer programs that can teach themselves to grow and change when exposed to new data.

• Integrations: Most artificial intelligence systems involve some sort of integrated technologies, for example, the integration of speech synthesis technologies with that of speech recognition.

• Deep Learning: Deep learning refers to artificial neural networks that are composed of many layers. It is a branch of machine learning based on a set of algorithms that attempt to model high level abstractions in data by using a deep graph with multiple processing layers, composed of multiple linear and non-linear transformations

• Computer Vision: It is the science that aims to give a similar, if not better, the capability to a machine or computer. Computer vision is concerned with the automatic extraction, analysis and understanding of useful information from a single image or a sequence of images.

Making an approach to pursue the most advanced technology takes a lot of innovation and it is exactly what Mantra Labs has been doing.

If you are keen to solve real world problem using AI, Drop us a line hello@mantralabsglobal.com

Knowledge thats worth delivered in your inbox