Robotic Process Automation(RPA) is a software that is designed to mimic the human back-office activities, especially for the repetitive and dreary tasks. RPA can perform these tasks at a higher pace effortlessly and effectively saving a lot of time, that can be used to perform other activities that need human strength like emotional intelligence, reasoning and customer interactions. The primary goal of RPA implementation is to streamline the tedious tasks of enterprises and automate as many processes as possible while leveraging the benefits of AI and machine learning tools.

Companies are adopting RPA to reduce the staffing costs and mitigate chances of human errors. The scope of RPA and the extent to which it can be customized is pretty extensive. It can be programmed to perform simplest of the tasks like sending an automated email to performing complex business processes.

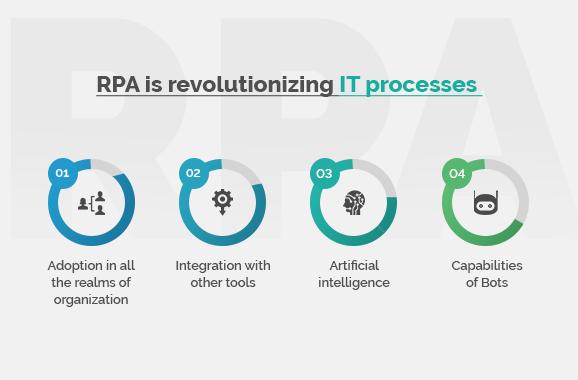

Here are the few ways in RPA is revolutionizing IT processes:

1. Adoption in all the realms of organization:

Organizations are adopting RPA not just for internal processes but also for external and customer-oriented processes. For example, the auto-response feature for the incoming emails is one field where RPA implementation can offer excellent productivity output. Several companies have already implemented RPA, and it has proven its potential, encouraging other firms also to embrace process automation.

2. Integration with other tools:

RPA implementation is a rich area for innovation and companies has already realized that they can reap more significant benefits from RPA when integrated with other technologies. In the next few years, one can expect that RPA together with cognitive automation will be capable of performing more complex tasks that are possible only by humans today. The term RPA might be replaced by SPA (smart rule automation) which lays the foundation of smarter business processes or intelligent automation process.

3. Artificial intelligence:

The basic RPA implementation by companies involves automation based on pre-defined conditions. The future version, i.e. RPA 2.0 will be integrating the concepts of AI and other machine learning tools making RPA much more than just a rule-based automation technology. To what extent it will get revolutionized will solely depend on the needs of individual organizations but the impact of RPA on the business processes is expected to be huge.

4. Capabilities of Bots:

Bots are capable of using the operating system just like humans. They can be programmed to open an email and send a response or log into an application or create files and folders. They can further be made to do data processing and perform functions like making calculations, following if-else conditions, extracting data from documents, scraping data from the web and a lot other things.

Types of RPA:

• Attended Automation: They are deployed at places where automation is possible but with human intervention. The assigned user will launch the bot to perform several functions automatically based on some pre-defined conditions. In case of an anomaly, the bot may ask the user for assistance.

• Unattended automation: They work in the background and are best for back-office employees. Most of these bots are triggered when new data is entered into the system and needs data processing for marketing and regulatory needs.

• Hybrid: Both the attended and unattended automation are combined for the front as well as back office operations. It helps to attain end-to-end automation of processes.

The hula-boo around RPA is not meaningless and is of utmost importance for all the enterprises. Where big firms are already preparing for the next level of automation other companies are also not hesitating to take the plunge into the RPA pool. In the next decade, RPA will not just be a fancy term but will become the conventional need of the businesses.

Knowledge thats worth delivered in your inbox