The insurance industry thrives on relationships—but it can only scale through efficiency, precision, and timely distribution. While much of the digital transformation buzz has focused on customer-facing portals, the real transformation is happening in the field, where modern sales apps are quietly driving a smarter, faster, and more empowered agent network.

Let’s explore how mobile-first sales enablement platforms are reshaping insurance sales across prospecting, onboarding, servicing, renewals, and growth.

The Insurance Agent Needs More Than a CRM

Today’s insurance agent is not just a policy seller—they’re also a financial advisor, data gatherer, service representative, and the face of the brand. Yet many still rely on paper forms, disconnected tools, and manual processes.

That’s where intelligent sales apps come in—not just to digitize, but to optimize, personalize, and future-proof the entire agent journey.

Real-World Use Cases: What Smart Sales Apps Are Solving

Across the insurance value chain, sales agent apps have evolved into full-service platforms—streamlining operations, boosting conversions, and empowering agents in the field. These tools aren’t optional anymore, they’re critical to how modern insurers perform. Here’s how leading insurers are empowering their agents through technology:

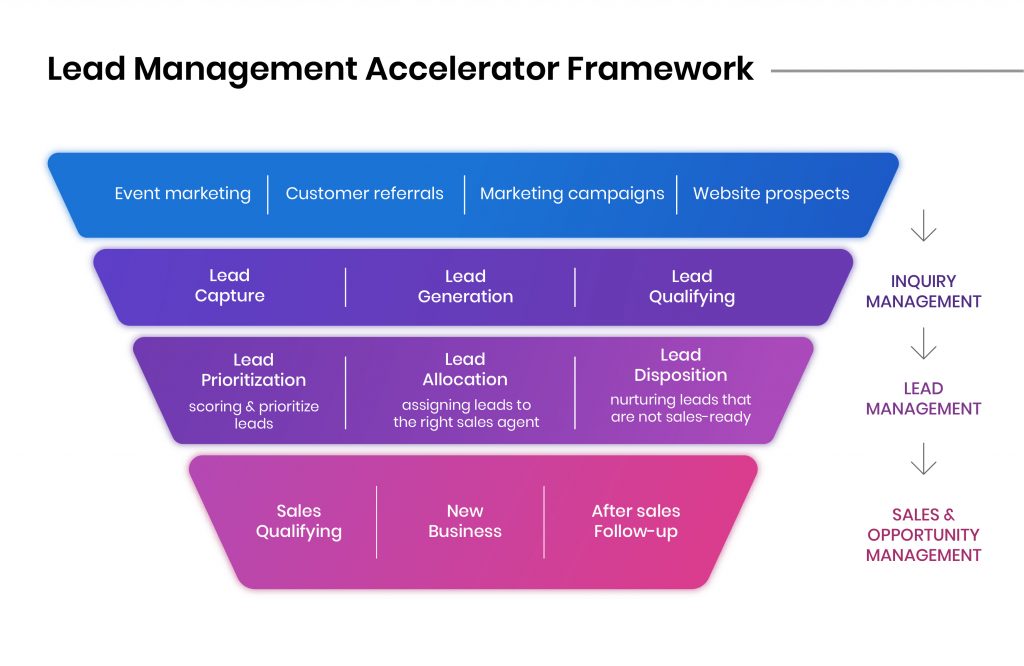

1. Intelligent Prospecting & Lead Management

Sales apps now empower agents to:

- Prioritize leads using filters like policy type, value, or geography

- Schedule follow-ups with integrated agent calendars

- Utilize locators to look for nearby branch offices or partner physicians

- Register and service new leads directly from mobile devices

Agents spend significantly less time navigating through disjointed systems or chasing down information. With quick access to prioritized leads, appointment scheduling, and location tools—all in one app—they can focus more on meaningful customer interactions and closing sales, rather than administrative overhead.

2. Seamless Policy Servicing, Renewals & Claims

Sales apps centralize post-sale activities such as:

- Tracking policy status, premium due date, and claims progress

- Sending renewal reminders, greetings, and policy alerts in real-time

- Accessing digital sales journeys and pre-filled forms.

- Policy comparison, calculating premiums, and submitting documents digitally

- Registering and monitoring customer complaints through the app itself

Customers receive a consistent and seamless experience across touchpoints—whether online, in-person, or via mobile. With digital forms, real-time policy updates, and instant access to servicing tools, agents can handle post-sale tasks like renewals and claims faster, without paperwork delays—leading to improved satisfaction and higher retention.

Using smart tools, agents can:

- Securely co-browse documents with customers through proposals

- Share product visualizations in real time

- Complete eKYC and onboarding remotely.

Agents can conduct secure, interactive consultations from anywhere—sharing proposals, visual aids, and completing eKYC remotely. This not only expands their reach to customers in digital-first or geographically dispersed markets, but also builds greater trust through real-time engagement, clear communication, and a personalized advisory experience—all without needing a physical presence.

Modern insurance apps provide:

- On-demand access to training material

- Commission dashboards and incentive monitoring

- Performance reporting with actionable insights

Field agents gain access to real-time performance insights, training modules, and incentive tracking—directly within the app. This empowers them to upskill on the go, stay motivated through transparent goal-setting, and make informed decisions that align with overall business KPIs. The result is a more agile, knowledgeable, and performance-driven sales force.

5. End-to-End Sales Execution—Even Offline

Advanced insurance apps support:

- Full application submission, from prospect to payment

- Offline functionality in low-connectivity zones

- Real-time needs analysis, quote generation, and e-signatures

- Multi-login access with secure OTP-based authentication

Even in low-connectivity or remote Tier 2 and 3 markets, agents can operate at full capacity—thanks to offline capabilities, secure authentication, and end-to-end sales execution tools. This ensures uninterrupted productivity, faster policy issuance, and adherence to compliance standards, regardless of location or network availability.

6. AI-Powered Personalization for Health-Linked Products

Some forward-thinking insurers are combining AI with health platforms to:

- Import real-time health data from fitness trackers or health apps

- Offer hyper-personalized insurance suggestions based on lifestyle

- Enable field agents to tailor recommendations with more context

By integrating real-time health data from fitness trackers and wellness apps, insurers can offer hyper-personalized, preventive insurance products tailored to individual lifestyles. This empowers agents to move beyond transactional selling—becoming trusted advisors who recommend coverage based on customers’ health habits, life stages, and future needs, ultimately deepening engagement and improving long-term retention.

The Mantra Labs Advantage: Turning Strategy into Scalable Execution

We help insurers go beyond surface-level digitization to build intelligent, mobile-first ecosystems that optimize agent efficiency and customer engagement—backed by real-world impact.

Seamless Sales Enablement for Travel Insurance

We partnered with a leading travel insurance provider to develop a high-performance agent workflow platform featuring:

- Secure Logins: Instant credential-based access without sign-up friction

- Real-Time Performance Dashboards: At-a-glance insights into daily/monthly targets, policy issuance, and collections

- Frictionless Policy Issuance: Complete issuance post-payment and document verification

- OCR Integration: Auto-filled customer details directly from passport scans, minimizing errors and speeding up onboarding

This mobile-first solution empowered agents to close policies faster with significantly reduced paperwork and data entry time—improving agent productivity by 2x and enabling sales at scale.

For one of India’s leading health insurers, we helped implement a full-funnel engagement and analytics stack:

- User Journey Intelligence: Replaced legacy systems to track granular app behavior—policy purchases, renewals, claims, discounts, and drop-offs. Enabled real-time behavioral segmentation and personalized push/email notifications.

- Gamified Wellness with Fitness Tracking: Added gamified fitness engagement, with rewards based on step counts and interactive nutrition quizzes—driving repeat app visits and user loyalty.

- Attribution Tracking: Trace the exact source of traffic—whether it’s a paid campaign, referral program, or organic source—adding a layer of precision to marketing ROI.

- Analytics: Integrated analytics to identify user interest segments. This allowed for hyper-targeted email and in-app notifications that aligned perfectly with user intent, driving both relevance and response rates.

Whether you’re digitizing field sales, gamifying customer wellness, or fine-tuning your marketing engine, Mantra Labs brings the technology depth, insurance expertise, and user-first design to turn strategy into scalable execution.

If you’re ready to modernize your agent network – Get in touch with us to explore how we can build intelligent, mobile-first tools tailored to your distribution strategy. Just remember, the best sales apps aren’t just tools, they’re growth engines; and field sales success isn’t about more apps. It’s about the right workflows, in the right hands, at the right time.