Table of Contents

01 Decoding the Customers’ Perspective

02 The Insurance Monthly Roundup

03 State of Indian InsurTechs in 2022

04 Innovative Insurtechs of 2022

05 Insurers are in the Emerging stage in CX Maturity Graph

Decoding the Customers’ Perspective

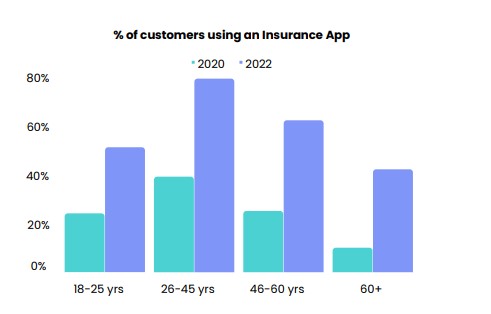

Consumer perspectives and expectations may differ due to the difference in their demographics. ‘One-fit-for-all’ approach may not deliver a great experience to insurance consumers. Over the last two years, a large number of customers, particularly older Millennials and Generation X, have shifted to mobile apps to purchase insurance. Surprisingly, insurance apps are becoming increasingly popular amongst the newest generation – Gen Z.

Insurance firms need to align their offerings with this generation’s appetite for digital experiences. Also, customer experience may vary as per the demographics and financial stability of the customer.

- Hyper-personalized solutions will elevate CX for existing customers: Customer retention has always been a challenge for the insurance industry and the cost of acquiring new customers is comparatively higher than the cost of retaining. For insurance firms, it becomes imperative to find out ‘what else can be insured?’ to increase the wallet share of the existing consumers who are searching for innovative and personalized insurance solutions to buy. Episodic (on-demand) insurance solutions and usage-based plans according to customer needs would generate cross-sell and up-sell opportunities for insurers. For example, Bajaj Finserv India offers episodic Insurance solutions such as adventure sports insurance cover to the customers.

- Affordability and Convenience: Keys to augment the reach in the under-served market: Insurers need to take an out-of-the-box approach to increase the wallet share across the lower-income strata, as they have a different set of expectations. A great buying experience for them would include: a) An easily understandable and affordable product b) a Convenient mode of payment c) Agents who can explain the product features and benefits they shall receive. Micro-insurance products and trained agents will help insurers to connect and build trust amongst this newer audience as they rely on them for all insurance-related transactions. Shriram General insurance India has announced a launch of a separate vertical for a rural section of the country. The company is planning to facilitate doorstep delivery of insurance to remote locations by opening micro-offices and onboarding 40,000+ agents.

State of CX In Insurance

Read the full report.

The Insurance Monthly Roundup

A quick roundup of the month’s insurance and insurtech news.

(India)

- Bengaluru-based Pazcare secured $8.2 million in a Series A funding round. The company will infuse this fresh capital to improve its product line and scale its business operations.

- Ensuredit earned $4.2 million to increase product lines and strengthen its technical workforce. The company also plans to invest in artificial intelligence, machine learning, and computer vision-based products to improve customer experience, optimize sales teams, provide business insights, and eliminate leaks in financial reconciliation.

- Tier-2 & 3 cities in India present a huge market opportunity for new-age insurance products like cyber insurance reveals Policybazaar’s latest annual survey.

(Global)

- Mali-based insurtech, OKO secured US$500,000 in the funding round. The company plans to use this capital to expand its operation on Ivory Coast.

- Upcover has garnered $2.7 million in a Seed funding round. The funds will be used in product development and acquiring new customers.

Top 10 Innovative Insurtechs of 2022

Read our Latest Blog here.

State of Indian Insur Techs in 2022

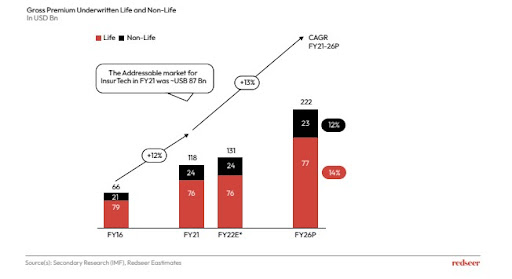

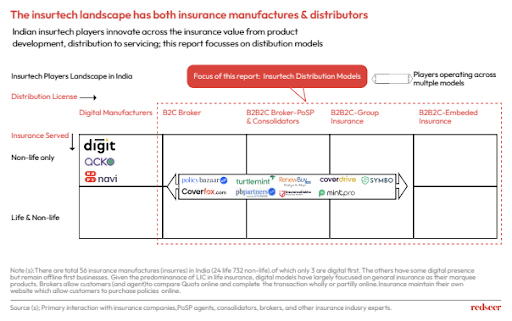

Insurtechs in India has completely transformed the way insurance industry used to operate. With massive deal-breaking investments going on in the insurtech landscape, insurtechs have emerged as the catalyst for boosting customer experience in insurance industry. Digital disruptions in the country have led to the emergence of new distribution models to increase insurance penetration. Here are some key findings from the latest Redseer Consulting report on India’s Insurtech industry landscape:

- India’s insurance penetration is expected to rise significantly touching $222 billion by FY26 due to the emerging middle class and acceptance of digital adoption. The current digital insurance penetration in India stands at a mere 2% as compared to China (6%) and US (14%) indicating a huge potential for expansion. A higher number of Indians are choosing insurance, notably life, motor, and retail health insurance. Particularly life insurance demonstrated strong results, accounting for about 3/4 of the market with plenty of possibilities for digital expansion.

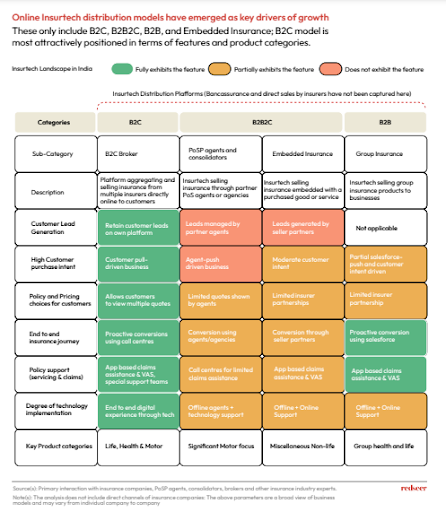

- Breakthroughs in digital technology have revolutionized the insurance customer experience in India offering convenience, transparency, and simple-to-use channels to boost penetration and accessibility of insurance products to consumers. InsurTechs are more customer-centric and focused on leveraging data and analytics to create personalized insurance solutions and to create a seamless customer experience through different distribution models (B2C, B2B2C, B2B models).

- Even though the different distribution models adopted by insurtechs differ in terms of economic viability, customer connect, and scalability, they all share the same vision – to make insurance as convenient and effortless as possible!

B2B2C: Business-to-business-to-consumer (B2B2C) distribution refers to the process of InsurTechs selling insurance via affiliated POS agents, agencies, or products or services that customers have already purchased. This model includes offline agents, with online support and is highly scalable. Given the potential for agent misselling, claims risk in this model is moderate.

B2B model: Include Insurtech selling group insurance products to businesses. The lapse rate is often low because of higher customer awareness and a broad base of policies further reduces the risk of claims.

B2C model: In the B2C model, customers benefit greatly due to a seamless end-to-end customer journey. Offerings in this model include visibility to multiple quotes, app-based claims support, proactive conversions leveraging contact centers, end-to-end digital experiences, and more. The claims risk in this model is significantly lower than that of the other two models since there is direct customer engagement. Due to increased consumer awareness, the persistence rate is also higher.

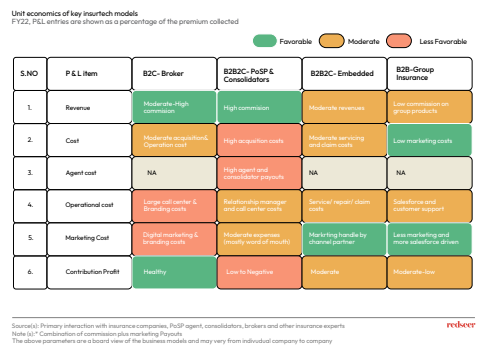

- Some InsurTech models are more favorable than others in terms of unit economics.

B2C brokers have much better contribution margins than B2B2C brokers; B2B2C also results in agent payouts even though it scales more quickly because of the uberization of agents.B2C brokers, on the other hand, use asset-light strategies and online marketing to generate larger profits. Furthermore, these cutting-edge models are improving the insurance experience not just for consumers but for agents too. Using digital tools, agents can boost their productivity by guiding them digitally from anywhere.

Why are Super Apps trending?

Read our blog here.

TOP 10 Innovative Insurtechs of 2022

Financial stability has become a global priority now. And the key focus has now shifted to insure everything around whether it’s people, pets, or things. With this emerging customer demand for insurance solutions comes the challenge of providing an exceptional customer experience. According to Gallagher’s report, 143 deals were recorded worldwide in the first quarter of 2022. Keeping innovation and customers at the center, here’s a look at the top ten innovative insurtechs of 2022 (in no particular order) –

ManyPets (formerly known as Bought by Many) is the first pet insurer in the UK to offer online form-free claims. Launched in 2012, the firm introduced its own branded policies backed by Munich Re’s Great Lakes Insurance. ManyPets built its policies using a customer-led model, which leverages anonymized search data and customer reviews to identify shared customer needs unserved by competitors. The current offering includes tailor-made insurance solutions like lifetime and accident coverage for cats and dogs.

ManyPets (formerly known as Bought by Many) is the first pet insurer in the UK to offer online form-free claims. Launched in 2012, the firm introduced its own branded policies backed by Munich Re’s Great Lakes Insurance. ManyPets built its policies using a customer-led model, which leverages anonymized search data and customer reviews to identify shared customer needs unserved by competitors. The current offering includes tailor-made insurance solutions like lifetime and accident coverage for cats and dogs. Dinghy is a London-based pay-by-the-second insurance provider that customizes coverage for freelancers and businesses. Using online and mobile-first solutions, customers may switch their policies on and off as needed without any upfront premiums, interest, credit checks, or fees. Dinghy also introduced ‘Freelance Assist’ where freelance legal professionals receive the flexible coverage of Dinghy with online resources and advice.

Dinghy is a London-based pay-by-the-second insurance provider that customizes coverage for freelancers and businesses. Using online and mobile-first solutions, customers may switch their policies on and off as needed without any upfront premiums, interest, credit checks, or fees. Dinghy also introduced ‘Freelance Assist’ where freelance legal professionals receive the flexible coverage of Dinghy with online resources and advice. Root is a US-based insurtech that offers insurance solutions to drivers in case of collisions as well as comprehensive protection and medical payments, personal injury protection, and more. At first, drivers need to download the mobile app and perform test driving for a couple of weeks. Once the driver passes the driving test, they are offered a premium based on their driving score generated during the test drive which differentiates the company from traditional car insurance.

Root is a US-based insurtech that offers insurance solutions to drivers in case of collisions as well as comprehensive protection and medical payments, personal injury protection, and more. At first, drivers need to download the mobile app and perform test driving for a couple of weeks. Once the driver passes the driving test, they are offered a premium based on their driving score generated during the test drive which differentiates the company from traditional car insurance. Riskwolf is a Switzerland-based insurtech that enables insurers to build and operate parametric coverage for digital risks unique real-time data and dynamic risk modeling. This prevents loss of income from internet disruptions due to bad weather, natural disasters, or accidental cable cuts. Riskwolf enables telecommunication, internet service, e-commerce, and other digital platform providers to raise real-time insurance claims by detecting connectivity problems and automating the payment process.

Riskwolf is a Switzerland-based insurtech that enables insurers to build and operate parametric coverage for digital risks unique real-time data and dynamic risk modeling. This prevents loss of income from internet disruptions due to bad weather, natural disasters, or accidental cable cuts. Riskwolf enables telecommunication, internet service, e-commerce, and other digital platform providers to raise real-time insurance claims by detecting connectivity problems and automating the payment process. Fitsense is an Australian insurtech that enables health & life insurers to customize products and services by using the app and device data. The platform captures health data from multiple wearable devices and health-tracking apps and then combines it to generate unique scores for its customers. These scores are then used to create personalized insurance policies to suit individual needs in real-time which helps insurance firms to minimize claims and increase revenue streams.

Fitsense is an Australian insurtech that enables health & life insurers to customize products and services by using the app and device data. The platform captures health data from multiple wearable devices and health-tracking apps and then combines it to generate unique scores for its customers. These scores are then used to create personalized insurance policies to suit individual needs in real-time which helps insurance firms to minimize claims and increase revenue streams.  Shift Technology is a Paris-based tech firm focused on creating AI-native solutions for insurance companies. The insurtech enables insurers to defeat fraud, cyber-attacks, or hacks, and automate claims.

Shift Technology is a Paris-based tech firm focused on creating AI-native solutions for insurance companies. The insurtech enables insurers to defeat fraud, cyber-attacks, or hacks, and automate claims.  Hippo is a US-based insurtech that provides property & casualty insurance, which covers the policy holder’s home and belongings as well as liabilities from accidents that occur on the protected property. The company leverages public data, satellite images, and smart home devices like water-leak sensors to accelerate the application process and reduce claims. Hippo claims a customer quote time of just 60 seconds and offers a complimentary smart home monitoring system to eligible customers combined with a discount.

Hippo is a US-based insurtech that provides property & casualty insurance, which covers the policy holder’s home and belongings as well as liabilities from accidents that occur on the protected property. The company leverages public data, satellite images, and smart home devices like water-leak sensors to accelerate the application process and reduce claims. Hippo claims a customer quote time of just 60 seconds and offers a complimentary smart home monitoring system to eligible customers combined with a discount.  Neosurance, headquartered in Milan, provides insurers with customer insights and a profiling platform. A push notification is delivered to the user’s smartphone along with a 7-second insurance policy sign-up. This enables the insurer to send the right insurance offer whenever the customer needs it.

Neosurance, headquartered in Milan, provides insurers with customer insights and a profiling platform. A push notification is delivered to the user’s smartphone along with a 7-second insurance policy sign-up. This enables the insurer to send the right insurance offer whenever the customer needs it.  Coincover provides corporate and consumer protection for NFTs through an insurance-backed solution. The company protects its partners’ wallets and the NFTs they possess from hacking, phishing, and other illegal activity, while also providing an insurance-backed guarantee if something goes wrong. Their offering also includes a disaster recovery service, which is a backup key recovery service that allows NFTs to be recovered in the event of lost passwords.

Coincover provides corporate and consumer protection for NFTs through an insurance-backed solution. The company protects its partners’ wallets and the NFTs they possess from hacking, phishing, and other illegal activity, while also providing an insurance-backed guarantee if something goes wrong. Their offering also includes a disaster recovery service, which is a backup key recovery service that allows NFTs to be recovered in the event of lost passwords. LivWell Asia is a blockchain-based gamified insurtech and health engagement application. The insurtech aims to make insurance accessible to millennials by making it rewarding and activity-based. Its offering includes low-cost bite-size health and term insurance in India and Vietnam aimed toward Gen-Z.

LivWell Asia is a blockchain-based gamified insurtech and health engagement application. The insurtech aims to make insurance accessible to millennials by making it rewarding and activity-based. Its offering includes low-cost bite-size health and term insurance in India and Vietnam aimed toward Gen-Z.

Businesses are heading to metaverse-based ecosystems where solutions based on blockchain technology are on the rise. Unique insurance solutions are clear evidence of rapidly evolving customer expectations. Hong Kong-based virtual insurer OneDegree teamed up with Munich Re to insure digital assets due to increased demand from Non-Fungible Token (NFT) holders seeking security against hacking and theft. With investments and advancements on the go, the future of insurance sure looks promising.

(Note: The insurtechs highlighted here are not rank-based and are not indicative of the ‘best’ insurtech products available today.)

AI and the Gen Z Experience

Read the full blog, here.

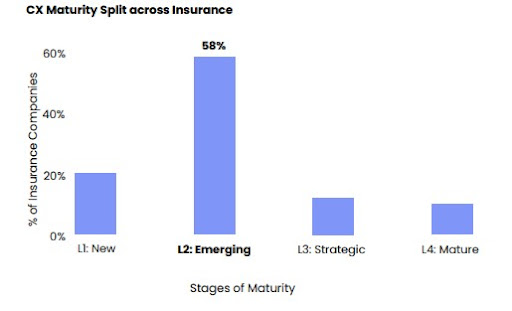

Insurers are in the Emerging stage in CX Maturity Graph

According to Mantra Research 2022, 58% of insurers agreed that they are in the Emerging stage in the CX maturity graph. International Data Corporation (IDC) predicts global IT spending in insurance will grow at a CAGR of 6% by 2024, hitting a market size of $135 billion, with customer experience accounting for 37% of this investment. This means more insurance organizations will be deploying AI, IoT, and data analytics to understand customer persona at the grassroots level and scale up customer experience across the entire value chain.

Technology has taken on a human dimension which is why the ‘phygital’ strategy is the new differentiator where CX will be the deciding factor in building customer loyalty and delivering richer experiences from here on out.

6G and the Future Customer Experience

Read our blog here.

Business cognizance for the new-age digital insurers