Snippets

‘AVO’ — FIRST VIRTUAL GENERAL INSURANCE LICENSE

Hong Kong-based Digital Insurer Avocado (or ‘Avo’), is backed by Asia Insurance in order to encourage wider use of technology by Hong Kong’s young adults. Avo is a younger and more appealing brand to millennials and young professionals. Avo is mostly B2C-centric offering products related to lifestyle, financial and health-related protection plans.

Read more here.

CARPE DATA — AN ALTERNATIVE DATA SOURCE FOR INSURANCE

The California-based insurtech offers data solutions to insurance companies by leveraging social media, online content, and other forms of alternative data. By accessing data relayed as a stream, insurance carriers can evaluate risks continuously over time to capture a more detailed and comprehensive insight into that risk.

Read more here.

Opinion

CONNECTED INSURANCE — HYPE OR REAL?

There is a strong correlation between the internet of things or the volume of connected things and the future of insurance. It is estimated that the total number of connected devices will touch 30 billion by 2020 — creating an unprecedented level of data offering new monetisation opportunities.

Here are three core areas where the business impact of connected insurance is evading ‘hype’ —

- Hyper-personalisation: If underwriters are allowed to price risk based on actual usage data, then both consumers and carriers can benefit from the data being exchanged. Usage based insurance garnered through technology effectively creates a unique price point that has been tailored specifically to that consumer. The end-user will be able to adjust the coverage needed based on the insights derived from actual usage versus hypothesised standard deviations derived from general population statistics.

- Real-Time Risk Tracking: By monitoring events in real-time, valuable insight into risk-causing behavior can reduce the likelihood of claims, fraud, price inflation. Using near real-time data can potentially improve claims evaluation and reduce claims settlement for carriers. To achieve this, insurers will need to adopt new real-time data streaming and analytics driven by artificial intelligence, which will operatively shift the dependance on historical data to price risk.

- Claims Prevention: The ability for insurers to continuously monitor the risks being covered in real-time can create the potential to reduce the likelihood of claims incurrence.

To achieve this, carriers will need to enforce two approaches: intervene in real-time based on indicative IoT data that identifies the possibility of risk occurring; or take a more educative approach to change the consumer’s behavior and promote safer prevention.

- The promise of the ‘connected insurer’ future is an optimistic vision — one in which the rise of ecosystems will bring together networks of businesses from multiple industries offering services on a common platform.

India is shopping a lot more with AI, this festive season.

Read our latest blog here.

Opinion

NEW PARTNERSHIPS ABOUND FOR INSURANCE INDIA

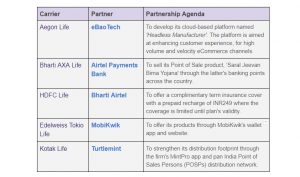

The year so far has witnessed an increased number of tie-ups between insurers and digital financial service providers who are looking to strengthen their online distribution and presence.

The industry is also witnessing an accelerated digitalization shift in the distribution landscape.

Other Life insurers are keeping up pace through increased activity along the digital transformation front, with initiatives notable for their overall cost-effectiveness.

- Max Life has launched its startup incubator program – Max Life Innovation Labs. As a part of this initiative, Max Life will tie up with startups to create futuristic solutions for seller hiring, intelligent data acquisition and financial management.

- DHFL Pramerica Life has partnered with MongoDB ATLAS to automate operational tasks and optimize performance of their database with reliability and speed. The insurer has also selected Amazon Web Services (AWS) as it’s cloud provider and will move the majority of its applications and data to AWS. These initiatives are expected to reduce its operating expenses by at least 15% in the next 12 months.

- Aditya Birla Sun Life has also embraced cloud technology by using virtual desktops on Microsoft Azure to reduce expenditure and enable employees to access data and applications seamlessly across branches.

These partnerships are indicative of a growing trend among carriers to leverage technology and distribution agility to expand their reach while minimizing costs.

How Are Organizations Leveraging Customer Feedback and Reviews?

Read our blog here.

Opinion

DIGITAL PAINS IN INSURANCE PERSIST, BUT ARE DEVOLVING

Insurance is a low-touch industry; 34% of customers say they do not interact even once a year with their insurer. According to Bain’s Global Digital Insurance Benchmarking Report, “Almost half of the insurers do not believe they have set up an achievable plan, because they are missing critical elements for the journey.”

So, how are customers shopping for Insurance?

Here is a look at some of the key factors influencing the new connected insurance journey.

- 40% of ‘insurance research time’ is spent on mobile devices.

- Customers with connected devices interact 19 times a year with their carriers, more than 4X the frequency of customers who don’t use connected devices.

- Connected customers tend to be more loyal and own more insurance products.

- More than 80% of Insurance customers in India (in 2019) are willing to share personal, health, financial and home security data with insurance providers — a trend that is declining in more developed and mature markets.

- In a recent study, the number of social opportunities for insurance is high but remains relatively untapped. In a single month, the study identified nearly 3.7 million tweets about insurance on purchase intent, and $15 million worth of insurance opportunities on social media.

- 48% of consumers are considering comments on social media when making insurance-buying decisions.

Customers increasingly expect an omnichannel interaction model with their insurer. By integrating technology seamlessly into the sales & distribution channel, insurers can benefit from having robust online and mobile capabilities, by turning a single enquiry into a long-term relationship.

The Real Impact of Everything-as-a-service

Read our latest blog here.

Country Profile

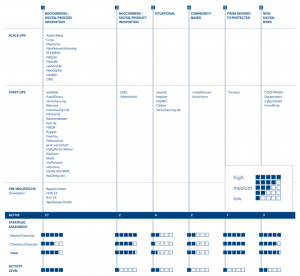

THE ‘HAPPY STATE’ OF GERMAN INSURTECH

- As of mid-2019, there are 134 active InsurTechs in Germany, up from only 20 in 2010. The growth rate has declined significantly, and the start-up boom has leveled off.

- ‘Neo-carriers’ form the largest division in the German InsurTech market, with 27 start-ups. They offer a ‘digital’ and ‘state-of-the-art’ interpretation of tried and tested insurance products.

- Some InsurTechs have increased their depth of value added becoming managing general agents (MGA). MGAs are often seen as “light versions” of a full-stack insurer.

- The emergence of distribution platforms is a new area of development, that up until now has failed to garner a lot of attention. Such solutions connect different players involved in the sales process and do not necessarily target the end customer, as they have no need to advertise their brand to end customers.

- Broker management vendors, such as Acturis and Hypoport, are seeing greater traction & visibility. These vendors are trying to make their insurance broker management software cloud-ready and are supplementing them with digital quote-to-bind journeys, rating engines, and other value-added services.

- There is a widespread willingness to cooperate between Carriers and InsurTechs. For Carriers, the ability to reach the younger generation with more appealing Insurtech brands has enhanced their distribution and reach. On the other hand, Insutechs have long realized that within the complex insurance landscape it is difficult to establish a successful business model without any distribution partner, product provider or risk carrier at all.

The German InsurTech Landscape, 2019

Our Other Profiles: Challenges for the Dutch Insurer.

Read the latest blog here.

Blog

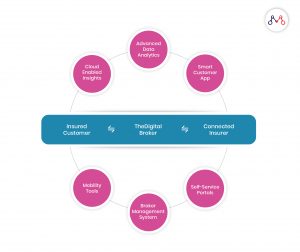

THE ’DIGITAL’ INSURANCE BROKER

Digital-first approaches have finally trickled down, turning ripe for adoption for this major distribution channel. However, broker adoption has still not caught pace with their agency counterparts.

According to a 2019 report surveying independent insurance brokers across the US, Canada & the UK, the average for digital technology adoption at an independent brokerage is only around 43%, even though nearly 96% of them (almost universally) use a broker management system for indispensable day-to-day operations. Interestingly, over 80% don’t offer any form of ‘mobile apps’ or ‘self-service portals’ for customers or staff.

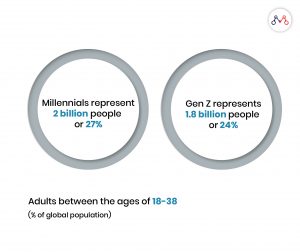

Today’s insurance customers are younger and prefer digital over traditional channels — leaving a lot of unmet gaps in the value chain. The Millennial base in India alone boasts some 440 million people, approx. 46% of the workforce.

The Case for a ‘Digital’ Brokerage

A digital broker business is built on these foundational blocks — robust broker management system, seamless mobility tools for employees, insurer connectedness, self-service portals, smart customer apps, advanced data analytics and the cloud.

According to a recent EY report on the state of digital brokerages, ‘digital onboarding tools’ and ‘sales leads & application tools’ were identified as attributes with the lowest satisfaction among brokerages. There is a growing sense that these tools need to be a cut above the industry benchmarks — in order to improve the digital relationship with a customer or prospect.

The Digital Broker can also leverage automation to improve efficiency in agent productivity and document handling processes. For instance, enabling employees with remote digital tools empowers them to quickly take action – from quoting prospects to providing policy details and managing claims for existing customers — especially when they need it most.

AI can create significant gains in operational efficiency and RPE.

Read the full blog here.

Blog

FIVE HIDDEN PROBLEMS FOR INSURTECH IN 2020

A new wave of AI-driven technologies is making subtle changes to the way young people are re-thinking the whole “Why do I need insurance again?” decision.

Millennials — are most likely to purchase insurance through an app with a few taps on their smartphones — are driving less frequently than previous generations — thereby creating a market for lower cost, pay-per-mile auto insurance.

Yet, despite the proclivity of this demographic to stay away from ownership (and, with that, the need for coverage), they do own assets that they want insured. Insurtech is well poised above all else, to satisfy their unique coverage needs.

A majority of the World’s insurance purchases are done physically (in-person), while only a small portion of sales comes from either the web or mobile – yes, even in 2019 and for the foreseeable future, that remains true.

How will insurtechs leverage useful insights to tackle age-old insurance selling challenges, such as intention to abandon, the propensity to purchase, or the right communication channel — will be the true test of competitive advantage.

Will newer challenges surface for Insurtech beyond 2020?

Read the full blog here.

Business cognizance for the new-age digital insurers