Over the last two years, between setting up new hospitals, handling the patient load, rearranging floors, and turning ICUs into covid wards quickly, the healthcare ecosystem faced a paradigm shift. Virtual visits that seemed like a mere possibility a few years ago, turned into reality in just a matter of months. Hospitals turned up at doorsteps and digital consultations became the new normal. The pandemic gave momentum to the rapid adoption of newer technologies by both providers and patients.

The Healthcare of Tomorrow

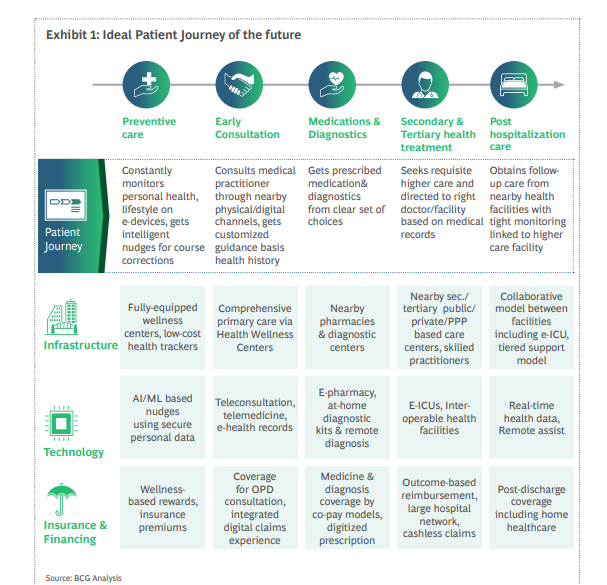

According to Deloitte, by 2040, health care as we know it today will cease to exist and the focus will shift from ‘healthcare’ to ‘health’. While it’ll be impossible to eradicate disease and illness completely, early detection, proactive intervention, and progress tracking will help to prevent serious consequences and promote well-being.

Smartwatch market share is expected to reach $ 95.78 Billion by 2028 and register a CAGR of 19.1%, according to Emergen Research. A 71-year-old woman in the US collapsed while she was alone, but the Apple Watch’s fall detection feature was able to warn her son and first responders. When she was taken to the health center, she was detected with a mass in her lungs that was cancerous. The future of healthcare will be strongly empowered by the digital revolution where the focus will be more on wellness rather than illness.

What does a Digital Patient of tomorrow want?

Patient loyalty is directly linked with their overall experience. According to Accenture, “Two-thirds of patients are likely to switch to a new health system if their expectations are not met.”

Let’s look at what a future healthcare consumer is looking for:

- Omnichannel Experience

According to Mantra Labs report, “healthcare providers that successfully initiate conversations, advise, engage and then close over multiple channels can potentially retain up to 7X more customers.”

Earlier healthcare customers relied more on in-person visits and consultations. But with change in consumer dynamics in the past two years, industries have shifted to omnichannel engagement strategy to reach out to their customers who now expect a similar experience in healthcare as well. They want flexibility and control to communicate with their providers on their own terms over all the channels via chat, web, email, text, and call.

- Digital Infrastructure is an absolute necessity

Covid-19 has taught us that there is an urgent need to build a strong Digital Infrastructure for a pandemic-like situation in the future.

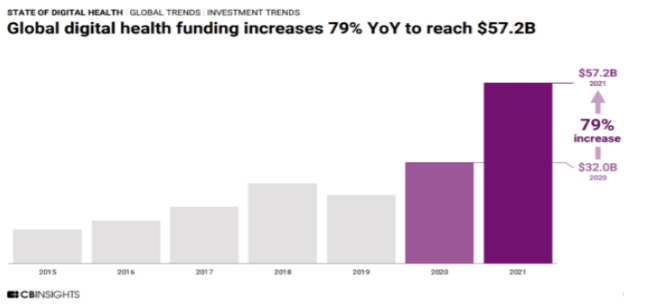

A study by CB Insights says, “Global digital investments in healthcare went record-high of $57.2 billion in 2021, a 79% jump from the $32 billion raised globally in 2020.” The number will keep going higher every year as there is a huge demand-supply gap in the healthcare industry. Providers would be better aligned with their patient’s demands if they invested in digital front-office transformation. This would also increase overall cost efficiencies.

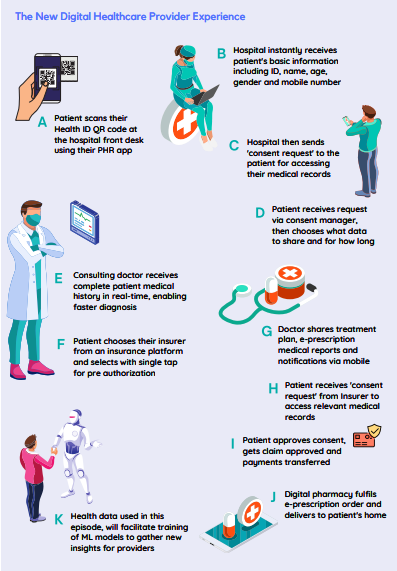

Recently, ₹200 Cr has been allocated by the Indian government to set up an open platform for the National Digital Health Ecosystem (NDHE) which will include an exhaustive list of digital registries of health providers and health facilities, unique health identity, consent framework, and universal access to healthcare. This will create a much-needed interactive and transparent platform for healthcare providers and seekers to manage stacks of health data in the country.

- Insurance & Financing

When it comes to healthcare, people have been compelled to pay for their healthcare coverage out of their own wallets, especially in developing countries like India. According to research conducted by the Public Health Foundation of India, healthcare-related expenses push 4% of India’s population below the poverty line every year. This creates an urgent necessity for insurance and healthcare partnerships to go beyond working in silos and integrate with each other for creating a better patient journey.

What does a Future Health workforce want?

There has been a massive shift in not just consumers’ but providers’ mindsets too. The health workforce has been the fastest to adapt and evolve into this new digital healthcare setting.

Coming out of this crisis, knowing what they want has become critical for healthcare organizations.

- Technology that benefits clinicians rather than the other way around

Collaboration solutions with real-time video and audio capabilities are rated as a significant sales conversation accelerator by 57% of healthcare agents.

Accenture found that since COVID-19, 60% of patients want to use technology more for their healthcare.

Given the fact that AI adoption rates surged by 51% in 2021, usage rates remain low. This shows that there’s a huge scope for the industry leaders to make conversational AI a better partner for healthcare providers.

- Regular training to upskill the workforce

Healthcare providers need to upgrade not just their technical skills but their soft skills as well to connect with the patient at a deeper level. With multitudes of data available to the doctor, what’s important for them is to train their clinicians and workforce to learn to process that data in a timely and meaningful way during the consultation.

Conclusion

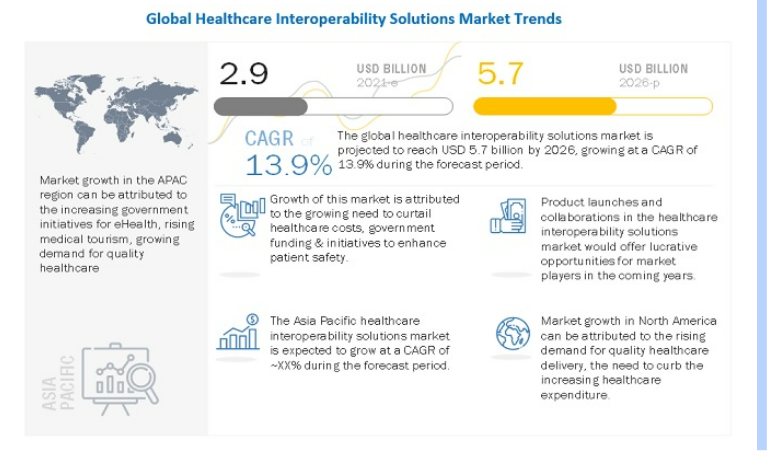

“The global healthcare interoperability solutions market is expected to grow from $ 2.9 billion in 2021 to $ 5.7 billion by 2026, growing at a CAGR of 13.9% during the forecast period 2021-2026”, according to marketsandmarkets.

Factors like lack of unified patient data, soaring patient demand, and an overburdened legacy health system have resulted in disjointed care experiences. The interoperability between different healthcare systems will facilitate healthcare practitioners to see a complete panoramic picture of their patients.

Health experts need to strike the right balance between digital and physical channels because the human touch will always take the center stage.

Going forward, the health industry requires a framework that allows them to remain agile during the healthcare crisis and be tech ready to provide a connected patient experience.

Knowledge thats worth delivered in your inbox