While InsurTech offers benefits via process efficiencies, cost reductions, or radical changes to the customer, it was under the late adoption category when compared to other financial industry sectors, as per a report from Deloitte.

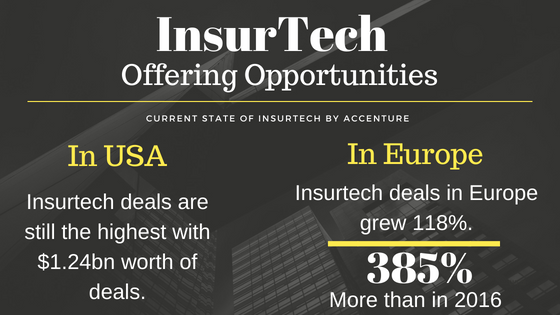

Figuring the current state of InsurTech, it is found by Accenture that InsurTech deals in the USA are still the highest with $1.24bn worth of deals. However, the number of insurtech deals in Europe grew 118%, while the value of deals in 2017 was $679m, 385% more than in 2016. Another report highlights that the UK is Europe’s largest insurtech hub, with 41 deals in 2017.

On the other hand, Insurtech in India is picking up the pace via its integration with modern technologies like Artificial Intelligence[AI], Machine Learning [ML]and the Internet of Things [ IoT].

So what were the factors that inspired Insurance companies to handshake with the advanced technologies? Or what were the dimensions in insurtech that encouraged people? Let’s have a look –

OPPORTUNITIES’ THAT INSPIRES INSURTECH

INNOVATION TO HELP MULTI-LAYERED STRUCTURE

Insurance is a multi-layer process, be it vehicle insurance that involves the owner, insurance firm and the vehicle seller or health insurance that requires patient, hospital and the insurance firm. The story could get a bit more complicated when coverage is provided via an employer, adding another layer of interaction.

Could disintermediation of the layers make it easy for customers to avail insurance? Well, yes a robust platform strategy is all you need. Just, for example, you may be approaching a corporate client to sell your health insurance policy; if some of the employees are using a type of health tracker device, it would be better to have a base of standard APIs and interface where all interface could connect and communicate.

Or picking another example, when your vehicle meets an accident, your smartphone could record and upload the photos on the integrated platform offered by the insurance firm and claim processing could be pushed.

MATCHING THE NEED FOR CUSTOMERS

The internet generation is keen to buy things in untraditional ways, while earlier government job was the norm, millennials are eager to own their business. To serve such a customer base, insurtech has been on their toes and offering customized insurance policies that may last for a trip or even for hours commonly known as Microinsurance. The ability to turn on and off your insurance policy is another creative way that has inspired people to buy insurance.

REVOLUTION TO CUSTOMIZE PRICING

Gone are the days when a full traditional policy was the norm and customers had no other option but to buy it. The customer is now attracted to innovative pricing models offered by insurtech firms. While the customer is planning his vacation via air, insurtech based on the data gathered could provide a customized 2-day or 5-day insurance cover. Or how about accessing the assets at home and providing insurance against burglary for your vacation time? Well, these revolutionary pricing model are helping insurtech to catch customer behaviour and allowing them to make fast claim processing via different tools.

IMPROVEMENTS WITH TECHNOLOGY

Integration with technologies like Blockchain, AI, and IoTs is helping people to avail enhanced services and operational development. While combination with Blockchain will help in building a higher level of trust, it also has the potential to offer new products. Pairing with IoTs would assist in gathering data and avoiding fraud claims. On the other hand, AI could help in automation of the age-old processes and documentation thereby streamlining the procedures.

Knowledge thats worth delivered in your inbox