The year 2019 has been a benchmark in insurance innovations that brought in new value propositions to the industry. What’s more remarkable is — both traditional Insurers and Insurtechs are striving to offer simple, convenient, and value-added customer-centric products coupled with technology initiatives. Here are 10 noteworthy insurance innovations that shaped the industry this year.

- Augmented Intelligence

- AI-based Smart Automation

- Digital Insurance Broker

- Services Beyond Insurance

- Blockchain in Reinsurance

- Unconventional Partnerships

- Understanding Customers and Delivering Tailored Products

- Insurance on Demand Services

- Risk Intelligence

- Customer Education

10 Most Impactful Insurance Innovations of 2019

According to a recent EFMA-Accenture report, the insurance industry has witnessed growth in digital sales & services, Artificial Intelligence trends — especially machine learning and natural language processing (nlp), big data and analytics, cloud, intelligent automation, and blockchain.

However, insurance players are not just adding convenience through technology but also understanding the ‘actual’ customer needs and developing the products accordingly. Let’s discuss the impactful insurance innovations with their use cases in detail.

#1 Augmented Intelligence

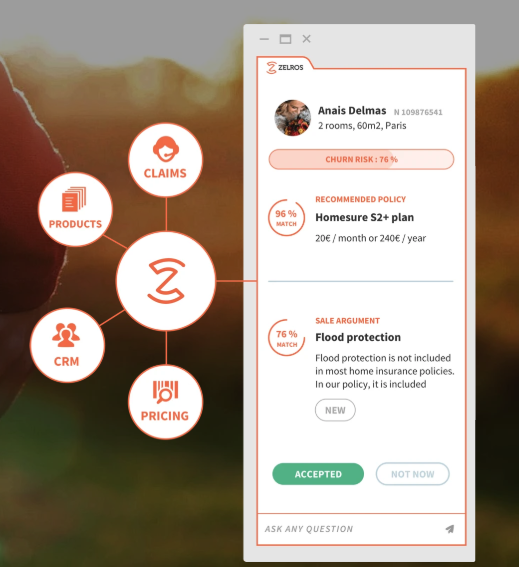

While most insurers are leveraging AI to understand customers and their requirements; another idea that hits the list is to complement the knowledge of insurance employees during sales pitches and customer services.

For example, Zelros is Augmenting intelligence of sales and customer representatives through real-time best product recommendations, advisory, and pricing based on studying the customer profile.

Similarly, Nippon Life Insurance Company has introduced an AI-powered TASKALL tablet for its sales representatives. This tablet identifies suitable prospects from the set of entire salesforce activities, thus enhancing the sales and customer representatives’ services.

#2 AI-based Smart Automation

Smart automation corresponds to deploying intelligent technologies to gain massive operational efficiency and at the same time create value for the end customer.

For example, South Korean Kyobo Life Insurance Co. Ltd. has developed an AI system BARO (Best Analysis & Rapid Outcome) to automate underwriting. The system uses NLP to allow sales and customer interactions in natural language.

In the same way, Religare incorporated AI-based chatbot in their workflow. Through this bot, the company has automated a number of operations like customer query resolution, customer engagement, and lead and ticket management.

Join our Webinar — AI for Data-driven Insurers: Challenges, Opportunities & the Way Forward hosted by our CEO, Parag Sharma as he addresses Insurance business leaders and decision-makers on April 14, 2020.

#3 The Digital Insurance Broker

In 2018, in the US alone, nearly 1.2 million people worked for insurance agencies, brokers, and insurance-related enterprises. This indicates the prominence of the brokerage in insurance. Brokers might not be directly involved in product development, risk evaluation, etc.; but they play a pivotal role in insurance distribution.

For example, Gramcover, an Indian composite insurance broking firm is leveraging mobile technologies to minimize the inefficiencies and transaction costs in distributing micro-policies.

Also read – The case for a digital brokerage

#4 Beyond Insurance

The year 2019 also witnessed the entry of technology giants like Alibaba entering the insurance space, and people welcoming them made the competition even more fierce. The World Insurtech Report 2019 states that nearly 30% of customers are interested in buying at least one insurance product from BigTech firms like Google, Apple, Facebook, Amazon, and Alibaba.

Insurers have thus realized to embrace the ecosystem-based digital economy to deliver richer customer experiences. AG Insurance’s Phil at Home is an example of ‘beyond’ insurance services to support customers in their day to day life. The app provides house maintenance services like plumbing, electricity, etc. along with medication reminders, food delivery, etc. to its elderly customers.

Also read – The Belgian Insurance Landscape

#5 Blockchain in Reinsurance

Blockchain or distributed ledger technology (DLT) brings transparency to a range of insurance processes along with the secure sharing of information. The innovative use of blockchain in insurance is to reduce redundant efforts.

For example, the US-based Aon Benfield along with partners have developed a blockchain-powered reinsurance placement solution to bring brokers and reinsurers on a collaborative platform.

Similarly, the Hong Kong Federation of Insurers in collaboration with CryptoBLK developed MIDAS (Motor Insurance DLT-based Authentication System) to authenticate motor insurance policy documents across the network in real-time.

#6 Unconventional Partnerships

Insurers’ partnerships with Insurtechs, Fintechs, and external players are presenting an opportunity to explore new customer base, test different business models, and get access to new technology frontiers.

For example, AXA partnered with ContGuard, which provides real-time cargo tracking services. Their product — Connected Cargo Solution gives customers 24/7 monitoring and data to AXA’s risk engineers to develop loss prevention plans. This also helps underwriters to quote the price with increased accuracy.

#7 Understanding Customers and Delivering Tailored Products

Addressing the customers’ demand for personalized services, Insurers have started applying AI to understand their sentiments and requirements. They have realized that real-time digital services unlock values for both carriers and customers.

For example, the UK-based Bought By Many helps people find insurance for uncommon assets like pets, shoes, gadgets, etc. The company also negotiates with insurers for the best deals.

#8 On-demand Insurance models

The World Insurtech report 2019 reveals that nearly 41% of customers are ready to consider usage-based insurance and 37% want to explore on-demand insurance coverage. While usage-based insurance models provide as-you-go premium coverage based on customer’s potential for risky behavior; on-demand insurance allows customers to get cost-effective and convenient coverage depending on their needs.

For example, The Dinghy is an app-based on-demand freelancer insurer. It is also the world’s first on-demand professional indemnity insurance covering public liability, business equipment, legal expenses, and cyber liability.

#9 Risk Intelligence

Insurers are deploying machine learning models for risk assessment and mitigation. It not only makes the underwriting more accurate but also boosts profits by diminishing risks.

For example, ZestFinance uses automated machine learning tools to correlate current and traditional data. It helps to effectively gauge risks and outreach potential new customers.

#10 Customer Education

Pricing still presents a bigger competitive advantage than many other insurance features. Accenture’s 2019 Global Financial Services Consumer Study states – more than 75% of customers can share their personal information for better prices.

Therefore, educating customers about potential risks isn’t sufficient. Coupling this information with available products’ prices and benefits is a must. For example, Jerry, a California-based personal insurance marketplace checks if the user is paying the best price for the insurance services. Based on an initial questionnaire, their AI-powered tools takes roughly 45 seconds to compare quotes from leading insurers and suggest optimum rate to the user.

Also read “Top 5 smartest AI-powered machines on earth.”

Knowledge thats worth delivered in your inbox