NewVantage Partners Executive Survey 2019 report states- 92% of the C-Level Executives are increasing their pace of investment in big data and AI. Artificial Intelligence brings forth revolutionary benefits to enterprises like personalization, automating customer interactions, real-time assistance, and much more.

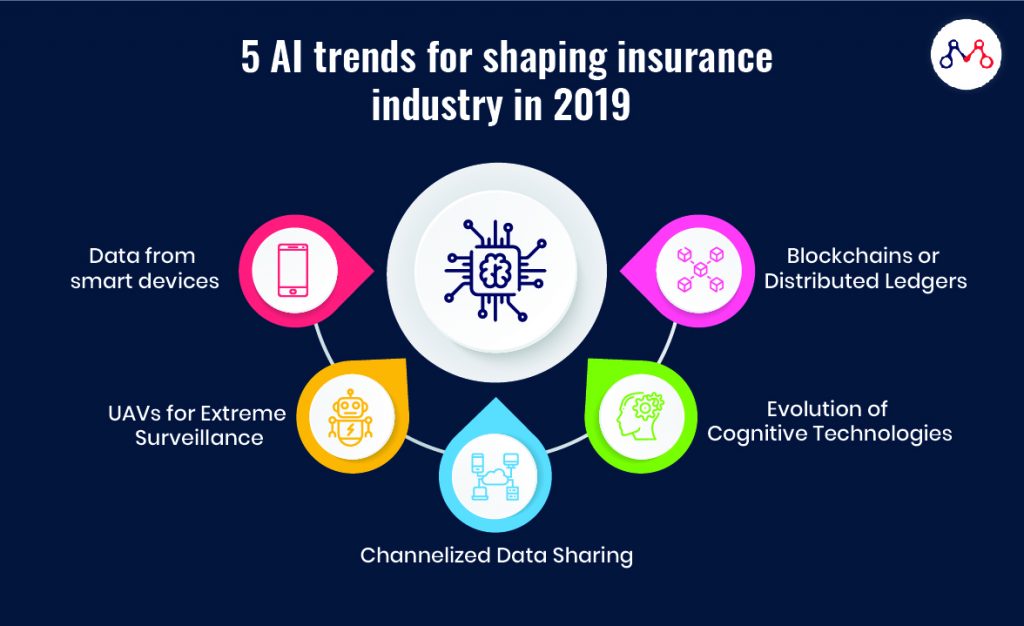

Here are 5 flourishing artificial intelligence trends in insurance.

#1 Data from Smart Devices

Smart devices like fitness bands, home assistants, smartwatches, etc. are meteorically becoming integral to our lifestyle. Smart clothing and medical devices are soon going to join the bandwagon.

The insurance sector can dive into the data generated by these smart devices to better understand their user preferences. This data can further help insurers create new and more personalized product categories.

#2 UAVs for Extreme Surveillance

AI-driven unmanned aerial vehicles (UAV), also known as drones can examine sites, which are otherwise extreme for humans to visit. Using such technologies for geological surveys can make the underwriting process more accurate. Also, deploying drones and robots can revamp insurance risk management strategies.

“It is estimated that by 2025 the number of autonomous vehicles will increase by 25%”

Source: doi.gov

#3 Channelized Data Sharing

Everyone needs data. Every industry is thriving to provide personalized products and services to its customers. Thus, one can expect private and public entities collaborating to create common platforms for data sharing.

The data-sharing platforms are GDPR-compliant and adhere to a common cybersecurity framework. Tech giants like Google, Amazon, and Apple have already sailed into this venture. They are able to bond with the lifestyle of users through cloud connectivity and smart devices and wearables. Technology can track instances of customers’ life. Guided data sharing can enable insurance companies to provide real-time assistance to their customers.

#4 Evolution of Cognitive Technologies

Cognition is an important aspect of Artificial Intelligence. Cognitive technologies in AI mimics how the human brain works. The recent improvements in technology can provide a better framework for processing humongous data, specifically gained from active insurance products tied to definite individuals.

With cognitive technologies, carriers can constantly learn and adapt to the world around consumers. This can enable insurance companies to not bring new product categories and engagement techniques but also respond to changing underlying risks in real-time.

#5 Blockchains or Distributed Ledgers

Breaking the traditional barriers of silos and centralization, 2019 is leaping towards the combination of the best of AI and blockchain for businesses.

For example, Smart contracts can automatically determine whether an asset can be transferred to a nominee or back to the source, or a combination of both. Blockchain can also simplify claims management, reinsurance, and underwriting.

Here’s more about how distributed ledgers can accelerate insurance workflows.

Well, the benefits of blockchain are not limited to large-scale insurance companies. Any InsurTech or FinTech firm or even e-commerce marketplaces can use blockchain to distribute micro insurances. The following infographic illustrates the projects successfully harnessing AI and blockchain.

Source: LiveTiles

We help startups and enterprises, build & scale AI-driven products and solutions for last-mile environments. Reach out to us on hello@mantralabsglobal.com to learn more.

Contributing Authors: Nidhi Agrawal (Content Writer @Mantra Labs)

Knowledge thats worth delivered in your inbox