DevOps has gained prominence in the past few years for its ability to develop, test, and deploy the software at a high velocity. The prime focus is to maximize the customer satisfaction, improve the product quality and its performance and speed up the development process. With all these powerful factors more and more enterprises are looking forward to adopting this technology, so it is essential to understand what will be the ruling trends in DevOps in the future.

1. Automation is the key

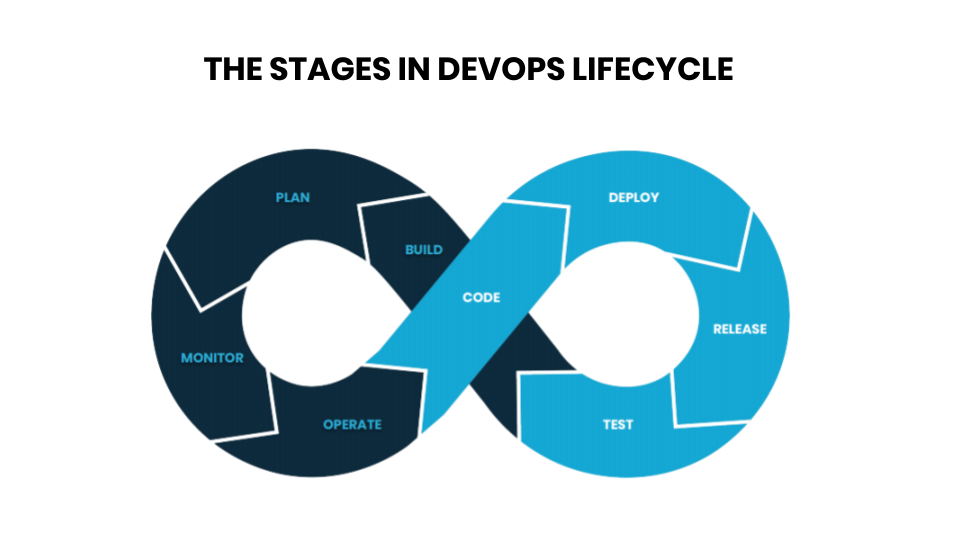

The automation strategies dominate DevOps and Zero-automation is the new Buzzword for the future. It doesn’t mean that you need to automate every component, but if it is the need of the hour, then you should have the capability to do it. The salient idea is to have a vivid picture of the 6C’s of DevOps development cycle and the implementation of automation between these stages.

- Continuous business planning

- Collaborative development

- Continuous testing

- Continuous release and development

- Customer feedback and satisfaction

- Continuous monitoring

2. Testers with coding knowledge

If you are a tester and have the experience of coding and running automated scripts for test cases then you will be in high demand in 2018. The era of manual testing will take a backseat because it is a time-consuming process which delays the development process. Automated testing is fast, efficient and reliable so testers working with DevOps tools will need to learn to code and create their test scripts.

3. Increased Demand for Microservice architecture

Microservices architecture allows companies to make changes quickly without influencing related systems and any other functionality. Companies are switching to this architecture to improve their delivery time and efficiency. Microservices architecture and DevOps practices, when merged, offer great agility and operational efficiency for the companies.

4. DevOps assembly line instead of CI pipelines

Pipelines help the companies to visualize the development process of their application from scratch until the production. As of now, companies are looking up for techniques to automate their complete software development cycle to speed up the delivery process. The future trends will focus more on Continuous delivery (CD) rather than Continuous integration (CI) and will shift towards adoption of DevOps assembly lines.

5. DevOps and security

Security parameters will become mainstream and will integrate with DevOps development cycle. The transformation of DevOps to DevsecOps will dominate the security market, and the developers will be accountable for the security of their applications. It will ensure that the applications are developed error-free and do not have any security loophole. The idea here is to make security the habit of the development team and instill the principles of a secure system in the development cycle itself.

6. Serverless technology

With the emergence of cloud technologies the dependence on servers is decreasing dramatically. In future, it is expected that there will be a spike in adoption of serverless technologies. DevOps is a supplement to serverless architecture that will help the organization to achieve excellent business agility.

Knowledge thats worth delivered in your inbox