Table of Contents

01 Are Machine Learning Use Cases in Insurance Evolving?

02 India’s General Insurance Market is Poised for Big Things in 2020

03 State Of AI In Insurance 2020 Survey

04 5 AI Predictions to Watch out for in 2020

05 The State of Predictive Journeys so far..

06 The Future of Faceless Computing & Voice UX

Insights

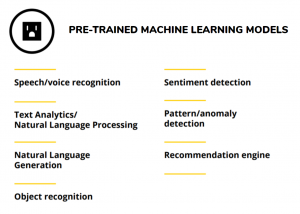

ARE MACHINE LEARNING USE CASES IN INSURANCE EVOLVING?

Most insurance companies process only 10-15% of the structured data they have access to. This means, there is potential for machine learning to unlock value from both structured and unstructured data throughout the insurance value chain.

Source: Deloitte Report – AI in Insurance

Is there potential for new ML Use Cases in Insurance?

Yes, the key to becoming a cognitive insurer is to make the most of your existing data. To achieve this, insurers must leverage the ability of advanced machine learning models.

- Insurance Advice: The models can prevent ‘lost business opportunities’ from slipping through the funnel by providing timely information to both agents & customers to resolve product queries — for consumers are seeking personalised solutions made possible by machine learning algorithms

- Fraud Prevention: ML is far superior to traditional predictive models because it can tap into unstructured and semi-structured data to retrieve timely insights about the claim. Lemonade, the World’s largest Insurtech, makes use of at least 18 anti-fraud algorithms that run in real-time before it can settle a claim in under a few minutes — improving the claims settlement process.

- Risk Management: For underwriters, predicting risk requires putting the data you already own to effective use — i.e, a streamlined flow of continuous data to understand the behavior of the customer. Health (40%), Home (38%) and Motor (48%) customers are already willing to share their personal information or have insurers track their behavior in exchange for more accurate premiums.

Millennials & Insurance Beyond Convenience

Read our Latest Blog here.

Opinion

INDIA’S GENERAL INSURANCE MARKET POISED FOR BIG THINGS IN 2020?

General Insurers (minus standalone health insurers) underwrote 1,707 Lakh policies during the financial year.

The main driving forces behind this growth are:

- Greater popularity and penetration of health insurance products

- Greater volume of transactions under fire, marine, export credit segments.

- Continuing demand for motor insurance

- Increasing availability of customised products

- Diverse & strong competition

Despite these positive attributes, the industry has a lot of ground to make. India’s non-life insurance density and penetration of $18 and 0.9% respectively stil stands much lower than the global average of $297 and 2.8% during 2019.

Why are private general insurers faring better?

- Multi-channel (bordering on omni-channel) distribution models

- Customer experiences are improving because of better AI & digital strategy

- Geographical expansion (Tier 3 & 4 cities)

- Efficient sourcing of business via multiple channels is lowering the commission expense ratio

India’s General Insurance Market is poised for Big Things

Read the Industry Outlook here.

Quick Survey

TAKE OUR SURVEY — THE STATE OF AI IN INSURANCE 2020

We want to know how YOU feel about THE IMPACT OF AI IN INSURANCE today.

The results of this anonymous survey will be published in our next Newsletter Edition.

Take our Quick 1 Minute Survey.

Insights

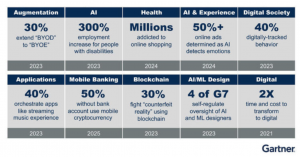

5 AI PREDICTIONS TO WATCH OUT FOR IN 2020

As investments in Artificial Intelligence continues to rise, research firms Forrester, Gartner and IDC have a list of both long & near-term predictions that will affect the future of business.

Other AI Predictions for 2020

- In 2020, the “tech elite” will ramp up their AI plus design skills by pairing human-centered design skills and AI development capabilities together.

- With more than 2,600 companies globally — the AI startup ecosystem, in 2020, will get saturated — marking the last new peak in AI funding.

- 25% of the Fortune 500 will add AI building blocks (text analytics, machine learning) redirecting AI investment to more tactical IPA projects with crystal-clear efficiency gains.

- Three new potential areas of AI malfunction will arise — the spread of deep fakes, incorrect use of facial recognition, and over-personalization.

- In 2020, senior executives like CDAOs & CIOs will ensure that data science teams have the data they need. The real problem will be prying them out of the hands of reluctant ‘data gatekeepers’.

Can Augmented Reality be a game-changer for Insurance?

Read our Latest Blog here.

Insights

THE STATE OF PREDICTIVE JOURNEYS SO FAR

- It is predicted that there will be nearly 2MB of data created by every individual in 2020, every second. With all this data to go around, customer experience will continue to be the number one marketing activity in 2020.

- 87% of organizations agree that traditional experiences no longer satisfy customers. insurance (39%) has the highest adoption for customer journey implementation outside of retail (42%). The tech industry comes up third behind them at 7%.

- Customer journeys are orchestrated into three: Acquisition, Conversion and Growth. Majority of journeys are identified as growth journeys (64%), and typically run for nearly 34 months on average.

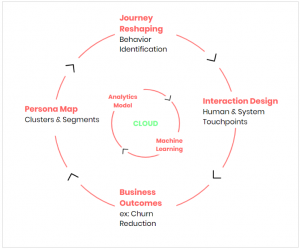

Continuous Predictive Learning Model

Predictive Journey Use Cases

Predictive journeys are allowing businesses to place real-time marketing bets on the behaviour of the customer.

- Identity Resolution — understanding the single-view persona consistently and accurately across -domain, -device and -channel, while maintaining stringent privacy compliance. (ex: LiveRamp, Full Contact)

- Customer Journey Data Integration — Multiple integrations like web, mobile app, email, social media, CRM, call centre, device, etc. are essential to transcend siloed view of customer flow across channels. (ex: FirstHive)

- Customer Segmentation and User Experience Recommendations — Clustering models produce highly accurate micro-segments that track each customer as they shift from one segment to the other. (ex: Lattice-Engines)

- Personalization — It marks which marketing campaigns, channels, touches, and behaviours users are responding to, and contributing to a business outcome, using a machine learning-based attribution. (ex: Everage)

- Lead Scoring, Prioritization & Allocation — It helps identify which leads will convert, churn and which customers will buy one or more products for a cross-sell or upsell. (ex: Mantra Labs LCA, Pardot)

- Automating Prediction & Rule Setting — Use automated machine learning for predictive modelling. Enables rapid iteration cycles. (ex: Nokia, DataRobot)

InsurTech beyond 2020 will be different. Here’s Why

Read our Latest Blog here.

Opinion

THE FUTURE OF FACELESS COMPUTING & VOICE UX

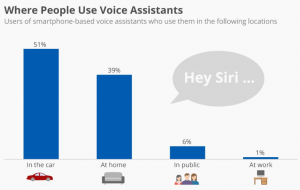

With the growing number of personal voice assistants like Alexa Siri, Google Assistant, and Cortana — Voice UI, also known as ‘invisible interfaces’, uses speech as the primary (and sometimes only) interaction medium between people and devices.

What’s driving the adoption of Voice?

One-third of the World’s population is already connected to a smartphone device with an in-built microphone that most people already use for recording simple message or creating new sounds.

At this stage, machines can transcribe human speech accurately 94% of the time.

In order to achieve this, a cross-device voice platform is needed to enable frictionless voice interaction.

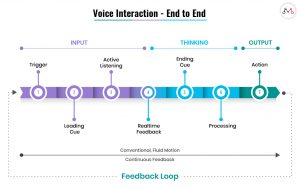

Here is a simple guide for enterprises looking to build the next set of voice-based interfaces for the mass market:

- Capturing Human (User) Intent: To understand a real person’s underlying expectations and intentions when relaying information using voice interfaces — we must translate the principles that govern human communication into the design experience.

- Real-time, Responsive VUI: The use of visual feedback to produce cognitive feedback using sounds, images and/or text to convey cues.

- Conversational UX: Creating empathetic, affirmative and corrective layers to human-to-AI interaction to deliver accuracy in understanding simple commands.

- Anthropomorphized UX: Giving human-like traits to voice interaction is anthropomorphization. This can be expressed as: patterns of lights, shapes that bounce, abstract spherical patterns, or computer-generated voices.

- Motion UX: Capturing fluid interaction — like facial expression, changes in tone, body language, etc. allows the user to maintain a dynamic experience while engaging in voice interactions.

10 Takeaways from the World InsurTech Report

Read our Latest Blog here.

Business cognizance for the new-age digital insurers