In 2019, InsurTech funding reached $6 billion, acknowledging the pace that technology can bring to overcome the age-old Insurance problems, the State of AI in Insurance 2020 says. While Incumbents are known for their core competencies in end-to-end insurance processes (from underwriting to claims settlement and reinsurance), InsurTechs are enticing millennials with fully digital innovative products and solutions.

The current situation can be viewed as either growing competition for traditional Insurers or an opportunity to collaborate and procure maximum benefits from each other’s competencies.

The World InsurTech Report 2019 states that nearly 90% of InsurTechs and 70% of Insurers are interested in collaboration with other InsurTechs and Insurance firms.

[Quick read: 10 Key Takeaways from the World InsurTech Report 2019]

In this article, we will discuss how InsurTech and Insurance partnership is proving beneficial for the entire ecosystem along with some successful partnership stories.

InsurTech and Insurance Partnership Benefits

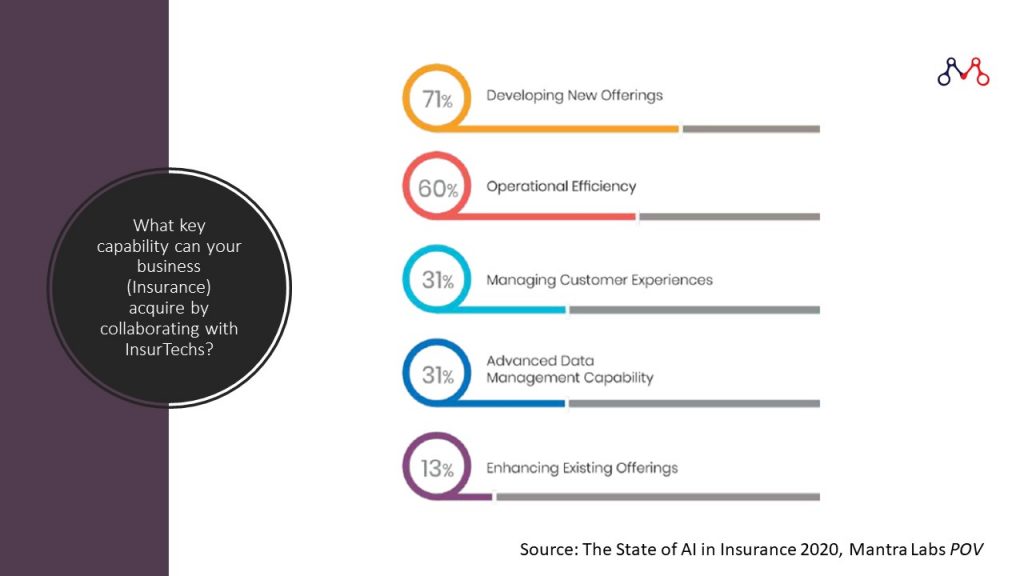

A recent study pointed out that 70% of Insurance Executives are interested in collaborating with InsurTechs for developing new offerings. While developing new & innovative offerings remains the focus, such partnerships can play a crucial role in improving operational efficiency, enhancing customer experience, and increasing data capabilities.

Enabling Mobile-first Business Model

The current generation cares about self-managing everything that matters to them (including Insurance) on mobile. If it’s not convenient to use, the consumer is, perhaps, not ready to adopt it. For instance, each day, more than 5 billion people go online using their smartphones or mobile devices.

InsurTechs, as consumer-focused they are, have been leveraging mobile technologies for micropayments, mobility and IoT connectivity.

Insurer’s benefits:

- Capability to extend their services/products to the mobile channel.

- Attracting new customers who are more inclined towards self-service options.

- Making information and services accessible and available everywhere, irrespective of geographical location, thus enhancing the customer experience.

Gaining Operational Efficiency at Scale

Insurers can harness InsurTechs’ capabilities on cutting-edge technologies like cognitive process automation, natural language processing, and ML-derived insurance analytics. Applications built using these technologies are scalable to the enterprise level.

[Related: Cognitive Automation and Its Importance for Enterprises]

For instance, with cognitive automation, Insurers can improve the efficiency and quality of computer-generated responses. Forrester predicts cognitive processes will overtake nearly 20% of service desk operations.

Similarly, InsurTechs are investing in developing workflow automation solutions, using which Insurers can create new automated workflows and/or customize existing workflows. Workflow automation with intelligent document and data processing capabilities has resulted in over 80% operational gains over manual processes.

Another milestone in improving operational efficiency is achieved through the adoption of chatbots. NLP-powered chatbots seamlessly integrate with an organization’s workflows and are a great way to humanize machine conversation and at the same time automate customer service portals.

Opportunity to extend the portfolio

InsurTechs still require traditional Insurers’ support for underwriting and during risk mitigation. On the other hand, Insurers are sceptical about micro and on-demand insurance because of the distribution challenges it poses for low-profit products. Insurers and InsurTechs can easily bridge the gaps and at the same time extend their range of offerings through strategic collaboration. Since 2017, Insurance and technology firms have announced more than 180 partnerships, KPMG states.

For example, American Family Insurance (AmFam) organizes its interests around innovation, advanced analytics, and connectivity. It has investments in CoverHound, HomeTap, Bunker, Wireless Registry, and LeaseLock.

“By making these investments, we do seek a financial return with the investment, but really we look for opportunities to work together, reconnaissance on how the world is changing.”

Dan Reed, MD, Managing Director, American Family Ventures

Source: Insurance Journal

Thus, InsurTech and Insurance partnership can also benefit from extending the product portfolio. Let’s now look at some remarkable examples.

4 Noteworthy InsurTech and Insurance Partnerships from Recent Years

1. Zurich Connect and Yolo

Zurich Connect, the digital arm of Zurich Italy, partnered with on-demand digital Insurance broker Yolo to provide virtual assistance to its customers. Together, they launched HomeFlix — to provide a range of Insurance coverage to renters and homeowners.

HomeFlix offers laundry service, concierge maintenance services such as plumbing and electric, and cleaning services to its customers along with regular and short-term insurance coverages starting at a nominal price of € 3.55 per month.

2. FRIDAY and Friendsurance

FRIDAY is a Berlin-based InsurTech startup. It offers digital automotive insurance with flexible terms like kilometre-accurate billing and the option to terminate at month’s end. The company partnered with Friendsurance, an online peer-to-peer insurance service provider. Friendsurance business model relies on paying out a percentage to customers who do not use (or use very little) annual insurance.

This partnership helps FRIDAY to sell at its policies on the Friendsurance platform and Friendsurance benefits from providing a range of insurance cover options to its customers.

3. Generali Global Assistance with Lyft and CareLinx

Generali Global Assistance is a division of Italy’s Generali Group. It provides travel insurance-related services. The company partnered with InsurTech Lyft and CareLinx to improve customer service and provide value-added services (e.g. CareRides, a door-to-door transportation service for special-needs individuals) respectively.

4. Prudential Singapore and StarHub

Singapore-based Prudential Insurance Company is the subsidiary of Prudential Plc, a British multinational life insurance & financial services company. The company partnered with StarHub to create FastTrackTrade — a digital trading platform. Using the FastTrackTrade platform, users can buy/sell goods, track shipments, make transactions, access financing, and buy insurance.

We’re a recognized InsurTech100 company with main focus on developing AI-first products and solutions for modern Insurance enterprises. For more details, please feel free to drop us a word at hello@mantralabsglobal.com.

Knowledge thats worth delivered in your inbox