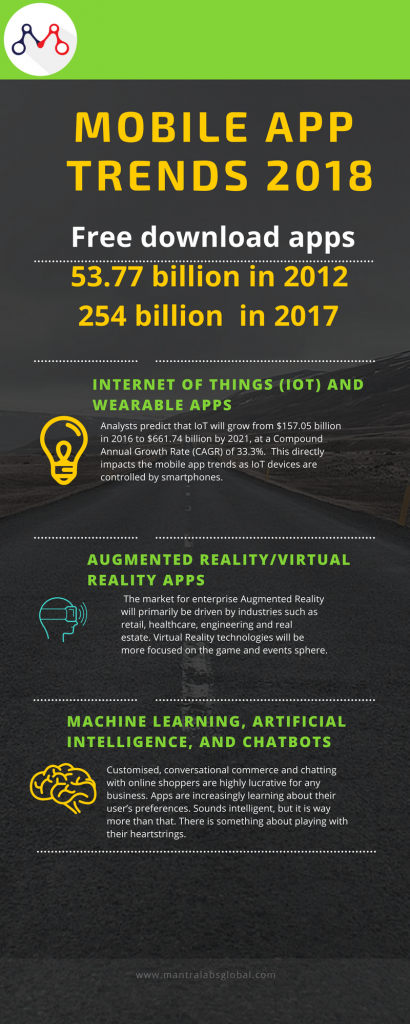

The year 2017 proved to be one of the best times to invest in Mobile app development. Enterprises have now realized that mobile apps are now a necessity. A Smartphone is a very best way to meet customer demands and increase sales. In the year 2017, the projected rise is 254 billion free downloaded apps, up from 57.33 billion in 2012, which proves mobile development is one of the most actively growing sectors in the industry. The key players are Google apps, social media, lifestyle and gaming apps. Large companies (retailers, banks, hospitality, etc.) are using mobile applications for branding, increasing customer engagement, direct marketing, etc., while small and midsize businesses are also following the mobile trend and creating their own apps.

Internet of Things (IoT) and Wearable Apps

The idea of a smart home, smart cities, industrial IoT, automotive industry, smart health, and smart retail is growing. From healthcare to education and smart homes to smart offices, IoT apps will gradually start becoming mainstream in 2017. Though it might take some more time for IoT to fully take off, it is here to stay. Apple watch apps are already booming and will continue growing. Google has also released Android Things to increase IoT adoption. As we see an increase in demand for connected things, apps will be required for smart devices other than smartphones, and developers will have to keep innovating to meet diverse needs. Analysts predict that IoT will grow from $157.05 billion in 2016 to $661.74 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 33.3%. This directly impacts the mobile app trends as IoT devices are controlled by smartphones.

Accelerated Mobile Pages

Since Google introduced the AMP project, page loading on mobile devices is accelerated. With AMP, you now see the quick loading of web pages on your mobile. Besides this awesome function, Google has declared that it will provide an isolated search index for the mobile web. From an SEO point of view, this step transforms all mobile app development approaches.

Accelerated Mobile Pages will help web apps to load more quickly on all mobile devices, reducing bounce rate. This change will also help publishers increase visibility to their ads and create a boom in the number of visitors.

Mobile Payments

Customers engaged in online shopping through Mobile Applications have been using Internet banking or Credit/ Debit cards to make payments. But with the introduction of Apple Pay and Google Wallet, customers are gradually shifting to m-commerce. It will be a good way for companies to harvest data and provide in-depth analysis of clients. As well as being a more comfortable payment option for customers.

Augmented Reality/Virtual Reality Apps

In 2017 AR and VR will start to go beyond entertainment and gaming. We saw the growth trend driven by consumer and business demand for new technologies last year. Both AR and VR possess huge potential when it comes to transforming a diverse range of industry sectors. The market for enterprise Augmented Reality will primarily be driven by industries such as retail, healthcare, engineering and real estate. Virtual Reality technologies will be more focused on the game and events sphere.

On-Demand Apps

On-demand applications are now very popular. They make our lives easier and more convenient, and we can use them from anywhere.

Enterprise Apps and BYOD

More and more organizations embrace the “Bring Your Own Device” model, we are going to see an upsurge in demand for hybrid enterprise apps. 72% of organizations have already started investing in BYOD for employees in some way or the other. In 2017 more than half of the world’s employers will require BYOD. Hybrid apps are known to run in the app form but are essentially mobile websites. This helps reduce the cost and speed the mobile app development process.

Cloud-based Apps

Mobile App Developers are designing more cloud driven mobile apps. With increasing use of cloud technology, it has become much quicker and easier to get data without impacting on your internal phone memory. With Dropbox, Google Drive and various other cloud apps, more and more mobile apps will be cloud driven. Cloud-based mobile apps are especially attractive for enterprises as they would largely alleviate the data security issues inherent in BYOD (Bring Your Own Device).

Android Instant Apps

Native apps that function like websites can attract more people with their convenience. Android Instant Apps don’t require installation all borders are removed from app and website. You can have all the advantages of your app within your site, with only one click. Run Android apps as seamlessly as loading a web page and save space on your smartphone, no unwanted app downloading

Application Security

The security of a smartphone is more crucial than ever because of the amount of personal user data it contains.Apps with built-in security features can make a large difference in the app space. More developers will be adopting the use of this platform, providing better UX with more security features. With this new programming language, we’ll begin to see more secure apps in the market. Mobile App Developers will be working harder than ever to ensure that every app they design comes with a safety guarantee in 2018.

Machine learning, Artificial Intelligence, and Chatbots

Customised, conversational commerce and chatting with online shoppers are highly lucrative for any business. Apps are increasingly learning about their user’s preferences. Sounds intelligent, but it is way more than that. There is something about playing with their heartstrings. It is emotional quotients of applications being upgraded by sheer bot observation! All off you know such amazing AI apps: Prisma, Siri, Google Now. We are expecting much more in 2017 keeping the AI mobile application development trend intact.

Lazy loading

Another great trend that we should expect in the upcoming year is related to the lazy loading technology. The thing is that the images that load for too long prevent the user from opening the whole article. It takes time to load the page, and users leave not willing to spend too much time on the page waiting. As a result, the bounce rate grows, and the conversion rates drop. So, to prevent this, technology gurus have decided to implement the lazy loading which basically means that images only load when their turn on the page comes. Otherwise, they do not overload the page.

Related:

1. Mobile app development trends in 2017

2. Learn Ionic Framework From Scratch in Less Than 15 Minutes!

3. Ionic Platform for Mobile App Development: Features & New Releases

Knowledge thats worth delivered in your inbox