Google announces some pretty interesting things at its I/O conference every year. Android Instant Apps is one of the things that really got my attention as it is compatible not only with the upcoming Android N but also with older versions of the popular mobile operating system.

Instant Apps were first introduced at Google’s I/O developer conference 2016. The technology had only been available to select developers until their Google I/O 2017 conference where Company announced that all developers can now build Instant Apps.

But what is Android Instant Apps? This is a feature that will pull bits of Android apps that are published on Google’s Play Store straight to your Android device when you need some functionality that is available in one of those titles.

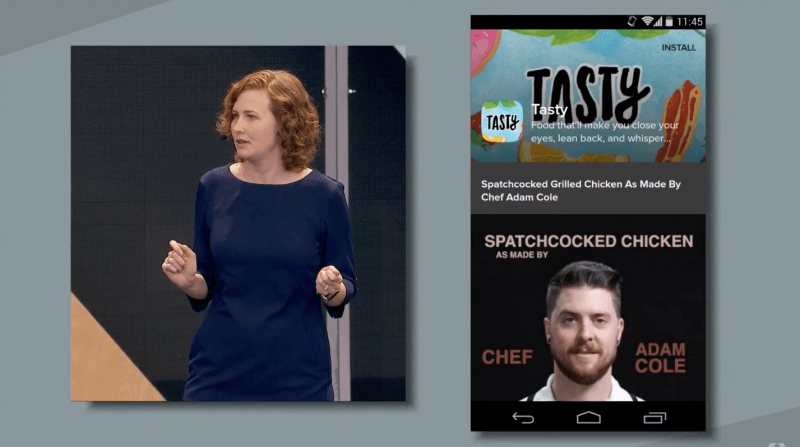

- For instance, as Google demoed, if a friend sends you a link to a BuzzFeed video and you tap on it, Android Instant Apps makes it possible for your device to pull just the part that it needs from the corresponding app to display the video but without actually downloading the whole app on your handset.

- Another example that Google showed at I/O, say that you want to pay for parking but you do not have the time to download an app that lets you do that. Android Instant Apps uses your handset’s NFC chip to get the necessary functionality from a compatible app to let you pay on the spot, and with Android Pay support nonetheless.

Instant Apps blurs the line between websites and apps you need to download, potentially shaking up the mobile Web experience. By offering a sliver of an experience of an app, it could also encourage people to download programs they might have skipped

Android Instant Apps makes your device much more useful and powerful. Normally, when you tap on a link, you are looking at a page opening in your favorite browser, which, depending on how optimized it is for use on a mobile device. You do not need to have all the features that an app can offer all the time, but there are times when you want to do more things or do them differently and this is where Android Instant Apps makes a big difference.

Those are just two examples though (there are three more below), and you can see a wider range of benefits to Android Instant Apps as more developers add support for it. As you know it can take a while before such features get traction, but this time round there’s a very big incentive in implementing it, if you do not count Google’s claim that it may take about a day to get this done. Android Instant Apps is compatible with Android versions as old as Jelly Bean.

Google has not specified which Jelly Been iteration is the oldest supported, but even if we are looking at the last one, which came out in 2013, there are still three current major Android distributions that Android Instant Apps works with.

The company is working with Disney on an Instant App version of its Disneyland app for checking wait times on rides. Other partners include blogging platform Medium, apartment rental service Zumper, a Buzzfeed food recipe app and yes, B&H Photo.

The technology behind Instant Apps is actually pretty simple, according to Kirkpatrick. As long as an app developer can break their app into modular chunks roughly a few megabytes each, Google can quickly download just the right chunk of the app to a phone and run it as if it were already installed. Apps can prompt the user for permission to share their location, fire up the phone’s camera, or use saved account information to log in.

It doesn’t even require the latest version of Android: Instant Apps will work with versions as old as Android Jelly Bean.

Let’s keep an eye on their developers conference this year, we will surely keep you updated.

Meanwhile, In case, you have any queries on Android Instant Apps, feel free to approach us on hello@mantralabsglobal.com, our developers are here to clear confusions and it might be a good choice based on your business and technical needs.

Check out these articles to catch the latest trends in mobile apps:

Knowledge thats worth delivered in your inbox