Our Services

Digital Product Engineering

CX Consulting

From Zero to One

Leading-Edge Frameworks

Web Application Development

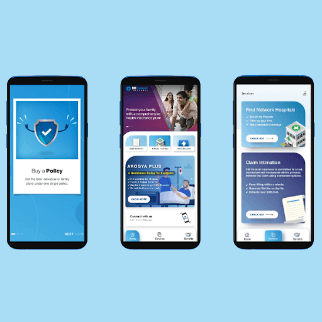

Mobile Application Development

Testing

Technology Transformation

Industries

Insights

About Us

Careers

Contact Us

Our Services

CX Consulting

Create superior customer experiences to enhance competitive advantage.

From Zero to One

Go from zero to breakthrough with scalable, future-proof solutions.

Leading-Edge Frameworks

Harness deep tech for smarter solutions and maximum impact.

Digital Solution Accelerators

Accelerate value delivery with powerful pre-built digital tools.

Web Application Development

Help businesses connect with an internet first generation.

Testing

Test the smarter way: where precision meets efficiency.

Mobile Application Development

Unlock real-time and personalized customer journeys for mobile first generation.

Data Science & Engineering

Turn data into decisive action with scalable AI infrastructure.

Platform Engineering

Design agile digital foundations that scale with tomorrow's business needs.

Software Reengineering

Build new-age architecture for maximum efficiency and hyper-growth.

Cloud Optimization

Fine-tune your cloud infrastructure for peak performance.

Industries

Insights

About Us